How much is the State Pension in Ireland?

As of October 2021, the current full State Pension (Contributory) is €12,912 per year (or) €248.30 per week.

The Irish State Pension will provide you with a basic level of retirement income providing you fully qualify.

The State Pension (Contributory) is awarded to people from age 66 who have satisfied the mandatory number of PRSI) contributions.

However, there have been whispers that the State Pension age was set to rise. Although, this has faced some opposition.

The Irish government is arguing that Ireland’s aging population will put a strain on the State Pension system in the future. It is estimated that the number of the population older than age 65 will have doubled to 1.56 million by 2051.

Therefore, the government would like to extend the State Pension age to 67 and then to 68.

They have estimated that should this decision be reversed, it will likely cost the State up to €50 billion in the long term.

Whether the government is right or wrong, either way, the State Pension is still a modest €248.30 per week and shows no signs of rising.

If anything, it is a system with huge liabilities and likely something the government would like to phase out. Therefore, relying on the State Pension as your sole source of income is a risky strategy.

What is the state pension?

The State Pension consists of two separate categories:

- Contributory

- Non-Contributory

The amount of PRSI contributions you have built up will depend on what category you fall into. Each category will pay a different weekly amount.

State Pension - Contributory

The Irish State Pension (Contributory) is awarded to individuals from age 66 or at present born in 1955 or before.

Should you fall into this category, your State Pension will not be means tested. This is a common misconception. So, should you qualify and have €1 million or €100 in your bank account, you will be entitled to the same amount which is currently €248.30 per week.

If you retire earlier at say age 65, you may qualify for a benefit payment until you reach age 66. In order to qualify for this payment, you must have stopped working and meeting the PRSI conditions.

Furthermore, while the state pension is taxable, you may not be taxed if it is the only revenue stream. According to Citizens Information ‘you may need to pay Universal Social Charge if your income exceeds €13,000.

State Pension - Non-Contributory

The State Pension Non-Contributory differs as it is means-tested. It is a payment for those aged 66 or over who do not qualify for the State Pension (Contributory).

Applicants are means tested under the following conditions:

- Cash income (including from work)

- Value of capital (savings, investments, cash, or property that is not your own home)

- Income from any property

It is worth noting that you can have savings or assets up to €20,000 and earnings of €200 per week and still qualify for a full State Pension (Non-Contributory).

| State Pension (Contributory) | State Pension (Non-Contributory) |

| €248.30 | €237 |

Any dependants both adults or children are also a factor.

If you are over age 80, you will also be entitled to €247 on the Non-Contributory rate.

How is the State Pension calculated?

As we touched on above, you will fall into two categories when it comes to the State Pension. Contributory or Non-Contributory.

One is based on your PRSI contributions and is not means-tested while the other is means tested.

The State calculate whether you qualify for the full Contributory pension while taking the following into account:

Are you over age 66 with enough Class A,E,F,G,H,N, or S PRSI contributions?

You will also need to have paid these contributions by a certain age and they also follow a new total contributions approach.

State Pension (Contributory) rate '2020' for individuals who qualified before 1st September 2012

| Yearly Average PRSI contributions | Personal rate per week | Increase for a qualified adult (under 66) | Increase for a qualified adult (66 and over) |

| 48 or over | €248.30 | €165.40 | €222.50 |

| 20-47 | €243.20 | €165.40 | €222.50 |

| 15-19 | €186.20 | €124.10 | €166.90 |

| 10-14 | €124.20 | €82.80 | €111.20 |

State Pension (Contributory) rate '2020' for individual who qualified on or after September 1st 2012

| Age: 48 or 0ver | €248.30 | €165.40 | €222.50 |

| 40-47 | €243.40 | €157.40 | €211.40 |

| 30-39 | €223.20 | €149.80 | €200.50 |

| 20-29 | €211.40 | €140.10 | €188.70 |

| 15-19 | €161.80 | €107.80 | €144.50 |

| 10-14 | €99.20 | €65.70 | €89.50 |

What if I only qualify for the Non-Contributory State Pension?

Perhaps you did not work or even worked abroad during large stages of your life. In this case, you may not be eligible to receive the State Pension (Contributory).

If this is the case, no need to panic. You will still be entitled to the State Pension (Non-Contributory) although it is means-tested.

You will likely lose out on approximately €11 per week. However, this is assuming you will be entitled to the full amount. To receive that amount you’ll need to be under certain thresholds.

As a recipient of the State Pension Non-Contributory, you will be required to undergo a means test. This will be assessed under the following conditions:

Cash Income

Any income you receive, including from work will be assessed. This may also include any pension you are receiving from another country. It is worth noting that certain income is not taken into account.

For example, if you are a participant in the Community Employment programme, this income will not be included in your means test. Other notable exceptions include payments under the Farm Retirement Scheme and any income from property that has already been assessed.

Value of Capital

Any savings, investments or cash on hand will all count towards your means test. Any property that is not your own home will also be assessed. The capital raised from these different sources will be added together and a formula used to calculate your weekly means from said capital.

Specific elements that may be assessed include:

- Savings in a bank account

- A property that you are renting

- Any stocks or shares you own

Should your spouse or civil partner also be claiming the Non-Contributory State Pension, any savings they have may also be taken into account.

Income from property personally used

The first point to note here is that the value of the house you live in is not taken into account. If you rent a room in your house, this income may be assessed. However, there are exceptions to this rule also.

If you sell your home, any income from this is usually taken into account and means tested. However, should your accommodation no longer be suitable you could potentially have up to €190,500 excluded.

You may be entitled to this exemption if:

- The purpose of the sale was to find more suitable accommodation.

- You are moving into a private nursing home.

- You are moving in with a person who is receiving the carer’s payment to care for you.

Should you satisfy one of the conditions, an exemption may be granted.

What is the State Pension (Non-Contributory) worth?

Let us assume you do qualify for the full non-contributory State Pension starting at age 66. In that case you will be entitled to €12,324 per year.

For this example we will assume you receive it 16 years.

| State Pension (Non-Contributory) |

|

€12,324 |

| 16 Years |

| Total – €197,184 |

That is quite a large sum of money over that 16 years period. However, it is means tested and will reduce should you pass certain thresholds.

Although, one major disadvantage of Contributory State Pension vs Non-Contributory is that you must be a resident within Ireland to continue to receive the Non-Contributory payment.

Therefore, you cannot live in another country and claim your State Pension (Non-Contributory) benefits.

Non-Contributory rate as of 2020

| Max personal rate | Increase for adult dependant age under 66 | Increase for a child dependant |

| Age 66 but under 80 – €237

Age 80+ – €156.60 |

€156.60 | Child under 12 –

€36 (full rate) €18 (half rate) Child under 12 years or older- €40 (full rate) €20 ( half rate)

|

How do I qualify for the State Pension (Non-Contributory)

In order to qualify for the State Pension (Non-Contributory) you must satisfy the following conditions:

- Be aged 66 or over

- Pass a means test

- Meet any other criteria as per the assessment

If you are unsure whether you meet the eligibility criteria, the citizen’s information website contains further details.

Will the State Pension change in the coming years?

According to recent announcments, the budget of 2022 has allowed for an increase of €5 to the current State Pension.

We have outlined the State Pension Contributory vs Non-Contributory and how much each may be worth should you qualify.

However, we have not commented on the fact even at the top of the scale you max out at just over €248 per week. Living on €35 per day is tough now, never mind in 20 years’ time.

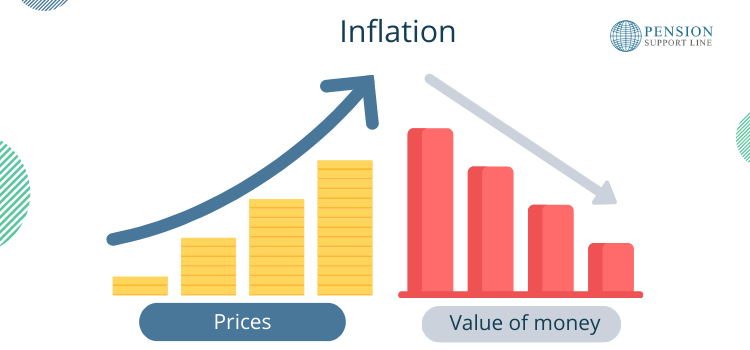

The main reason it will get tougher over time to live on such a modest amount is due to inflation. As we are all too familiar with, the price of goods and services has continued to rise since we can remember.

Even if we take 2020 vs 2021 as an example. The Consumer Price Index (CPI) stated that prices were up on average 2.2% in 2021.

A real life example of inflation is the humble ‘Freddo’ bar. A favourite among Irish people for generations. However, perhaps due to the prices always being displayed on the packaging, it has come in for some criticism.

Although, we could argue that Cadbury is simply maximising profits, inflation has also played a role in these price increases.

As we see from the graph above, although the figures are not exact, it gives us a rough outline of how inflation works. Although current rates are quite slow, inflation is still silently eating into any savings you may have.

Therefore, the ‘real’ power of any savings you have will likely be worth much less in several years’ time.This is also true for the State Pension whether it be Contributory or Non-Contributory.

Even the maximum €248.30 is going to have far less buying power in the future. The cost of goods may also rise faster than inflation as we see in our Freddo example.

This is a less than ideal combination and will see many struggles financially in retirement.

How much will the State Pension be in 2022?

The government recently announced there will be a change to the State Pension in 2022. An increase of €5 per week will be introduced from January, 2022.

These new measures were announced in October by Minister for Public Expenditure, Michael McGrath. The changes form part of the 2022 budget where €55 million of social welfare measures were announced.

Although, even with a €5 increase, the State Pension will still be a modest €253.50 per week. Probably not quite enough for that cruise around the Caribbean.

The table below shows the comparison of the 2021 State Pension vs the 2022 changes.

| Current State Pension (Contributory) | Proposed 2022 State Pension (Contributory) |

| €248.30 | €253.30 |

How stable is the State Pension System?

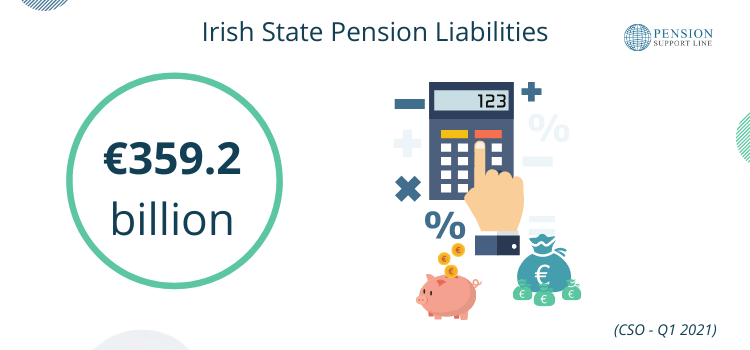

Thus far, we have ignored the fact that the current State Pension system has huge liabilities approaching €360 billion. However, these liabilities should not be ignored.

With these figures it is no surprise the government has hinted at raising the age you receive the State Pension from 66 to 67.

The government has also tried to push people towards starting a private pension. The uptake has been positive with almost 1.4 million workers in Ireland now having a private pension in place.

The State Pension system is under stress and shows no signs of alleviating.Ireland’s aging population will continue to pile the pressure on an already strained system.

It is estimated that the number of those over age 65 will reach 1 million by 2031 and 1.56 million by 2051.

|

Year |

Population age 65 or over |

| 2006 | 468,000 |

| 2031 | 1,000,000 |

| 2051 | 1,560,000 |

It is difficult to see how a country will cope with sustaining a system with huge liabilities that continue to mount. Considering your future and financial stability may be more important than ever before.

The figures above outline how planning to rely on the State Pension could be a risky move.

Are you planning to rely on the state pension?

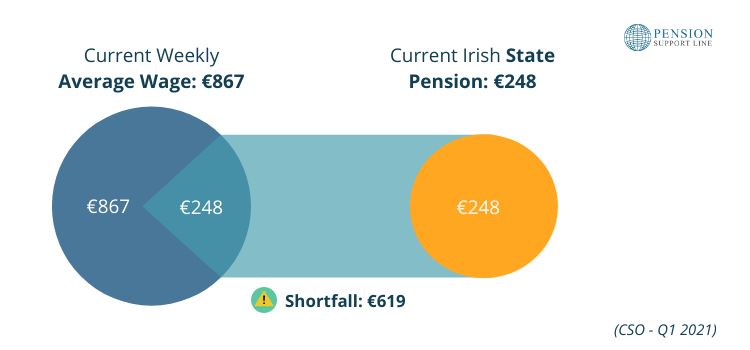

Relying on the State Pension being your sole income in retirement may make life difficult. When compared to the current average wage in Ireland, you will experience a huge drop in income.

A difference of €596 per week would be tough for anyone to overcome. Even if your working income is lower, dropping to €248 per week with any basic living expenses will be demanding.

Taking the time to start a pension now will save you trying to live off of €35 per day in the future.

How do I apply for the State Pension

You can contact one of the below:-

- Local Social Welfare Office

- Intreo Office

- Local Post office

We know Covid-19 is a major problem when trying to access your local office.

Here is a link to ‘Intreo centres and local branch office’ so you can find out any other relevant details, i.e. Contact details etc.

https://www.gov.ie/en/directory/category/e1f4b5-intreo-offices/

It is worth noting that, sources recommend that you should apply a couple of months before you turn the qualified age (66). If you have paid contributions in other Countries, it would be a good idea to apply even earlier.

The benefits of starting a private pension

Starting a private pension will have many benefits. The most important is that it will help you appropriately plan for your retirement.

Luckily, we are living longer, healthier lives than ever before. Therefore, you should plan to enjoy those extra years how you would like.

Not only will having a pension in place assist with this, but the government has also put in place incentives to encourage people to save.

Tax relief on contributions

One of the major incentives of contributing to a pension is the fact you will receive income tax relief on your contributions.

For example, if you are in the 40% income bracket, contributing €100 to a pension will actually cost you €60.

| 20% Tax Bracket | 40% Tax Bracket | ||

| €100 | Total Investment Into Your Pension | €100 | |

| -€20 | Less Tax Saved | – €40 | |

| €80 | Net Cost To You | €60 | |

As we see above, the ‘real’ cost would only be €60. Should you contribute the same amount and be in a lower tax bracket, your ‘real’ cost would be €80.

However, there are limits as to how much you can contribute whilst receiving tax relief.

Tax-free growth

Another advantage of contributing to a pension is the fact your fund will grow tax-free. Being free from taxes will allow your fund to accumulate over time.

Tax-free lump sum at retirement

Often, as you reach retirement you may be eligible to access 25% of your fund tax-free. This is a huge incentive for many as it releases a lump sum usually at a time you are looking to travel or tick off some bucket list items.

How can I start a private pension?

We have gone through why starting a pension is a good idea and the benefits you can avail of. You will be glad to know that the process of starting a private pension has also never been easier.

We offer a simple 6 step process.

We also assist clients in a wide range of pension planning and different pension arrangements. Some of these include setting up:

- Personal Retirement Saving Account (PRSA) – This type of arrangement is often used for anyone who is an employee.

- Executive Pension Plan (EPP) – These are often set up by limited companies on behalf of company directors.

- Self-Employed Pensions – As a self-employed person you may have the option of a Personal Pension or PRSA.

A major benefit about pensions is that it is never too late to start. In fact, the older you are, the more you can contribute and claim tax relief.

Whether you are looking to start a pension at age 30, 40, or 50, we would be happy to help guide you through the process.

Why do people not have a pension arrangement in place?

It is fair to say at this stage that the majority of people agree having a pension arrangement in place is a good idea.

Although almost 1.4 million of us in Ireland have a pension in place, some are still without any arrangement. We have seen the liabilities of the State Pension system and know how difficult living on €248 a week will be.

However, as seen from the CSO graph above, some of the reasons people do not have a pension would be worrying. For example, 34.5% of 45-54-year-olds stated their reason was they “never got around to organising a pension.”

Such a blase attitude towards pensions and saving for retirement is what is causing concern for the government. That is a large number of people who will be dependent on a combination of some savings and the State Pension to live in retirement.

They are also in an age bracket where they could contribute between 25-30% of their income and receive tax relief.

Can I claim both the Irish and UK State pensions?

As we live on an island that contains two separate countries, it is likely many of us would have worked in Northern Ireland or the UK at some point.

Whether you are entitled to both a UK and Irish State pension will depend on the number of social insurance contributions you have in each jurisdiction.

There are some resources available should you require information on either of the above.

How much will I need in retirement?

Figuring out how much we will need in retirement can be difficult. There will be variables such as the lifestyle you would like and your spending habits.

We carried out our own survey and the results showed that on average, respondents stated they would like approximately €433,000.

If you were to rely solely on the State Pension you would fall significantly short of this figure. Therefore, having a private pension in place will be important to filling the gap.

The full State Pension (Contributory) will only get you to €12,912 annually. If you were to receive this for 16 years that is €206,592.

This will leave a shortfall of €226,408.

Is there anything else I should consider?

Figuring out how much we will need in retirement can be difficult. There will be variables such as the lifestyle you would like and your spending habits.

Overall, relying on the State Pension is a risky move to put it lightly. It is a system under pressure that has huge liabilities. Whether you fall into the State Pension (Contributory) or Non-Contributory will depend on the factors we discussed.

Hopefully reading this blog has provided some clarity around the State Pension and how the system works. If you are still unsure of any details, we’d be happy to try and answer any questions you may have.

Our goal is to help as many people as possible debunk the pension myths and assess their options.

Feel free to contact our team today!

Book Your Complimentary Consultation

*This blog should be used for information only and not taken as financial advice.