As a business owner, the term ‘retirement relief’ probably is not something that was front of mind. However, as you spent years building the business you always knew there would be a day where it would be sold or passed on.

Either way, you have put blood, sweat and tears into building a successful business so it is important to know your options.

If you decide to exit the business and pass it on, understanding how to do so in a tax-efficient manner is vital. Capital Gains Tax (CGT) will be front and centre as we look at potential retirement relief methods throughout this blog.

How does Retirement Relief work?

As you begin to plan an exit from your business, it is only natural that you will look to reduce any tax liabilities. By availing of retirement relief, it may enable you to significantly reduce the tax bill.

Retirement relief is a relief on Capital Gains Tax (CGT), which can be applied in particular circumstances where an individual is disposing of all or some of their ‘qualifying assets‘ of their business.

There are certain qualifying conditions when applying for retirement relief. Thresholds also apply with regard to the relief which we look at in greater detail later on.

Qualifying Assets

A qualifying asset can take a variety of forms but generally fall into two categories:

- Assets used in connection with the business.

- Shares in the business.

It is worth noting that there are specific provisions relating solely to farming. However, for the purpose of this blog we will ignore such provisions.

Qualifying assets breakdown

Below we will look at sme of the qualifying assets in more detail.

Chargeable Business Assets – These may be assets such as land or premises that are used for trading purposes. However, you must have owned the assets for a minimum of 10 years on the date of the disposal. Furthermore, any tangible moveable property, such as plant and machinery, need not be owned for 10 years.

Shares or Securities – These may be assets if held for at least 10 years in the family company. The individual must have been working for the company for at least 10 years and have been a full-time director for at least 5 of those 10 years.

Land & Machinery – These will qualify once the land and machinery have been owned and used throughout the 10 years ending with the disposal. The land and machinery must be disposed of at the same time and to the same person as the shares.

Chargeable business Assets

These are assets used for the purpose of trade, profession, office or employment carried out by the individual, the individual’s family or a company which is a member of a trading group whose holding company name is the individual’s family company.

Chargeable business assets examples would include:

- Land

- Buildings

- Plant & Machinery

Goodwill is also considered a chargeable business asset. Shares and other assets held as investments are excluded.

Assets which do not fall under the category of chargeable assets would include:

- Stocks

- Debtors

- Cash

Definitions to note

While assessing your situation and eligibility for retirement relief, there are some key phrases you are likely to come across. Below we explain what they mean in simple English.

- Family Company – The individual in question must hold (a) at least 25% of the voting rights or, (b) provided the individual is a family member, hold 75% of the voting rights, the individual must hold not less than 10% of those rights.

- Family – In the case of a family, the individual’s spouse, relatives of the individual, and relatives of the individual’s spouse.

- Relative – Includes brother, sister, ancestor, or lineal descendant.

- Trading Company -This refers to a company whose business consists wholly or mainly of the carrying on of one or more trades or professions.

- Trading Group – A group of companies consisting of a holding company and its 75% subsidiaries, the business whose members taken together consists wholly or mainly of the carrying on of one or more trades or professions.

Retirement relief and anywhere a business or money is being inherited can be tricky. Often the definitions are full of acronyms and difficult to understand. If you are unsure, always enlist the help of an advisor.

Retirement Relief - Qualifying Conditions

Although it is referred to as ‘retirement relief’ you do not have to retire to meet the conditions. Below is an overview of the criteria:

- The disposal must be made by an individual (can not be by a company)

- The individual must be at least 55 years of age at the time of disposal

- The disposal must be of qualifying assets (as we discussed earlier – business assets, shares etc)

- The qualifying assets must be held for a minimum period prior to the disposal. This is usually 10 years.

- If the disposal is of a family company shares, the individual must have been working as a director for a minimum of 10 years prior to the disposal.

As we see from the above, periods of ownership play a significant role when it comes to retirement relief and eligibility. This along with the age of the individual making the disposal must always be considered.

Retirement Relief when disposal is to a child

We will now look at in more detail how disposals to a child are calculated and what reliefs are available. The stipulations are as follows:

- If you are between the ages of 55 and 65, a parent may claim full tax relief on the disposal of any ‘qualifying assets’ to their children.

- As per a change to legislation in 2014, if you are over the age of 66 on the date of the disposal, relief will be restricted to €3 million.

Therefore, if you are intending to pass on assets, it is important that you do so at the correct time. After age 66 you must consider the thresholds.

Any child receiving relief also cannot dispose of the assets within 6 years or clawback will apply. Clawback is the Capital that would have been due if no relief was applied. The clawback is paid by the child who received the assets.

When using the term ‘child’ it can refer to the following:

- Son or daughter

- Stepchild

- Adopted child

- Child of a deceased child

- Niece or nephew who has worked full time in the business or farm for at least five years.

- Foster child who was maintained for at least five years before they turned 18 years old.

Proper estate planning is imperative to ensure that you reduce any inheritance tax liabilities.

It is worth noting that this will be dependent on all other qualifying conditions being met.

Retirement relief when disposal is to someone outside the family

When assessing retirement relief for those outside the family there are certain thresholds that apply.

Again, we will assume what you are disposing of will be ‘qualifying assets’. If so, you may be eligible for relief depending on your age and relationship with the individual being passed the assets.

| Age | Relationship (being disposed to) | Limit |

| 55 – 66 | Qualifying Child | No Limit |

| 66 or over | Qualifying Child | €3 million |

| 55-66 | Other than a child | €750,000 limit |

| 66 or over | Other than a child | €500,000 limit |

It is worth noting that the above are with regard to retirement relief and eligibility. If these amounts are exceeded you may be liable to Capital Gains Tax (CGT).

Full retirement relief

In some situations you may be entitled to full relief. If an individual is between the ages of 55 and 66 at the date of the disposal then they may be entitled to relief of up to €750,000.

Therefore, if the assets received totalled €750,000, the Capital Gains Tax (CGT) payable may be reduced to zero.

Example

Shaun, who is 62 years old, sells his family business for €730,000. If no retirement relief was applied there may be a Capital Gains Tax (CGT) bill. However, should Shaun qualify for retirement relief and as the proceeds do not exceed €750.000, there would be no CGT payable.

Marginal Relief

In some cases, the assets received may be over €750,000. In this case, marginal relief may be applied to the amount of chargeable tax on the disposal.

Example

Michael, who is 59 years old, sells his family business for €850,000. In this case, full relief would not be available. As we know, the limit for full relief is €750,000. Therefore, the excess would be €100,000. If Michael claims marginal relief, the liability will be the sale amount of €850,000 minus the €750,000 which equates to €100,000.

Therefore, the Capital Gains Tax (CGT) due would be half the excess which is €50,000.

As you can see, significant savings from CGT tax liabilities can be made using retirement relief whether it be full or marginal.

What is the difference between Retirement Relief and Entrepreneurial Relief?

Entrepreneurial Relief works similar to Retirement Relief where it can be applied to reduce a Capital Gains Tax bill in certain circumstances.

In the case of Entrepreneurial Relief, is eligible the Capital Gains Tax bill could be potentially reduced to 10%.

However, the relief only applies to the first €1 million of gains. There is also a maximum of €230,000 per individual with a lifetime limit of €1 million.

Can you claim both Retirement Relief and Entrepreneurial Relief?

Although somewhat similar, there are distinctions to be made between the two.

| Retirement Relief | Entrepreneurial Relief |

| Applies to the sale or transfer as well as any gain being received. | Reduces the rate of Capital Gains Tax payable. |

With Entrepreneurial Relief, the €1 million threshold plays an important role.This €1 million is a lifetime limit on any chargeable business assets gained since January 2016.

This means that any prior sales or transfers of chargeable assets on which a gain arose must be aggregated even if Capital Gains Tax Retirement Relief was applied.

Any gains over this €1 million threshold will be taxed at the standard Capital Gains Tax rate of 33%

How do I plan for retirement relief?

As with any type of retirement or inheritance planning, the key is to start early. Additionally, having an advisor experienced with these situations will be worth their weight in gold.

Also, once you pass age 66, certain limits are imposed even on the disposal to a child. This is something that needs to be kept front of mind when planning to pass on a business or assets.

None of us enjoy paying taxes but they are a part of life. However, if you plan appropriately, you may be able to reduce any inheritance tax liabilities.

As we have seen throughout this blog, retirement relief has various rules and stipulations. Whether it be disposal to a child or marginal relief, understanding the factors that affect eligibility is vital.

It is also important to understand what are ‘qualifying assets’. Many of these assets must be owned or held for a certain period of time before disposal. Again, this is an aspect that should not be overlooked.

Taking a holistic view of your situation will be a key element of planning. Each situation is different and may require a slightly altered approach.

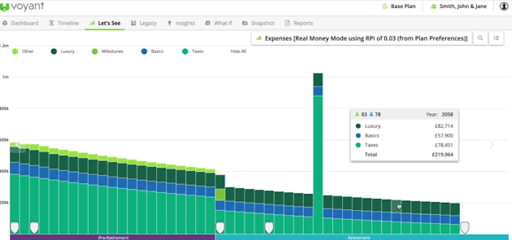

Taking into consideration assets, income, debts and any expected expenditure is a good starting point. Using these, you can begin to use a cash flow model to gain a better understanding of what you may need in retirement.

Of course, the lifestyle you would like to live will have a huge impact on what may be required. However, looking at the cash flow model is a good starting point.

As with anything related to retirement planning, giving yourself time and starting early is always advisable. Sitting with an advisor and creating a roadmap leading up to and into retirement is key.

Cash Flow Modelling

Cash Flow modelling is used by financial planners to help forecast your future finances.

This allows you to see in real-time how much money you may have in the future and if you are on track to hit your financial goals. We often hear questions such as ‘how long will my pension last in retirement?’ or ‘how much do I need to retire in Ireland?’.

Using cash flow modelling software allows you to track your current situation and help predict where you may end up in the future. This is done by collecting information such as :

- Monthly outgoings

- Savings

- Investments

- Other assets

From here your advisor can analyse the information along with your future goals and begin to put a plan in place. You can also discuss any one-off expenses such as a car purchase or gifts to children which will all be taken into account.

As you can see from the screenshot above, the cash flow modelling software can take many variables into account helping you plan for the future.

If you would like to discuss arranging such a consultation, please contact our team.

How much do I need in retirement?

After organising the passing of your assets, it is time to enjoy the fruits of your labour. Although we spend most of our life working, many of us cannot live how we would like in retirement.

It can be difficult to estimate how much we need in retirement and unfortunately many people underestimate the amount required. Of course there is no one-size-fits-all answer as we all have different needs and circumstances.

Even retiring at age 66, you will need a significant amount to enjoy any sort of a lifestyle. Although in retirement you may still have bills and basic living expenses.

Some people may choose to rely on the state pension which in itself is a risky strategy considering it is a modest €35 per day. That is without taking inflation or its liabilities into account.

The state pension is also a system with liabilities of nearly €360 billion. Therefore, it may not be a viable option for the State in the future.

Planning for retirement - the next steps

After reading this blog, you are now aware there are several elements to be considered when it comes to retirement.

If you are planning to be eligible for retirement relief, there will be rules and stipulations attached. Even the name can be slightly confusing as you do not have to actually retire when disposing of your assets.

We also looked at ‘qualifying assets’. It is important that the assets you plan to pass on actually qualify for relief. Otherwise there may be some Capital Gains Tax (CGT) liabilities.

The age at which you choose to dispose of your assets will play a key role. As we see, waiting until after age 66 may cause some complications from a tax perspective.

Overall, the area of retirement relief can be tricky to navigate. Enlist the help of an experienced professional who can help you weigh up your options.

Certain options that may seem attractive may not be best long-term. With this area there will be numerous factors that need to be considered.

If you are unsure on any of the above or would like to discuss your options, we offer a complimentary consultation.

| Contact Details: | |

| Email: | info@pensionsupportline.ie |

| Phone: | 01 890 3518 |

| Zoom Meeting: | https://calendly.com/pensionsupportline/pension-support-line |

Book Your Consultation

(We provide a complimentary consultation over the phone or Zoom, where you can assess potential options)

*This blog should be used for information only and not taken as financial advice.