Are you thinking of using your pension fund to buy property?

Owning a physical property is quite an attractive option to many people. However, having the finances readily available to acquire such property is where it can be difficult. Particularly, in today’s climate with rising house prices.

Therefore, many people look towards their pension to see if it is a viable option to acquire a physical asset such as property.

Buying property through your pension has become more and more popular in recent times.

However, whether you can use your pension fund to buy a property will depend on certain factors.

In this article, we’ll run through how it all works, if you are eligible and what restrictions may be in place.

Is it possible to use your pension fund to buy property?

Yes, it is possible to use your pension to buy property. Although, there are certain limitations in place. You cannot purchase property through your pension if it is part of an occupational pension scheme. These will often fall under Defined Benefit (DB) or Defined Contribution (DC) pensions.

You can buy a property through specific types of pensions such as:

- Approved Retirement Funds (ARFs)

- Small Self-Administered Schemes (SSAS)

- Personal Retirement Savings Account (PRSA)

- Personal Retirement Bond (PRB)

However, there is a European Union (EU) directive known as IORP II. This particular directive aims to standardise and provide consistency across pension funds within the EU.

This new directive impacts single-person schemes and self-administered pension schemes with regard to what assets they can hold.

There are approximately 100,000 such schemes in Ireland. There are also various stipulations involved that will be specific to each scheme.

If you are in such a position, it would be best to organise a chat with an advisor.

We understand this stuff can sometimes confusing or overwhelming.

This is why we offer a no-obligation consultation so you can chat to an advisor and assess potential options. This can be done through email, phone, video call, or reach out to our live chat.

After this hopefully, you will have a clearer idea of what you would like to do.

How do I use a pension to buy a property?

As with most things pensions-related, there is no one-size-fits-all approach when it comes to potentially using your pension to buy a property.

It is worth noting again that only specific pension types will be eligible to purchase a property.

There are quite a moving parts but some steps to start the process would be:

- Sourcing a qualifying property you would like to buy.

- Ensuring you have the full amount to cover the purchase price already within your pension fund.

- Making sure you have the correct pension fund set up.

- Organising the transfer of funds to the relevant bank account.

- Taking care of all legal aspects associated with such a purchase.

Using the above steps will give you a good starting point.

Using your property to buy a pension can be quite technical, ensure you have an experienced advisor by your side throughout the process.

What types of pensions are eligible to purchase property?

Having the option to use your pension to buy a property will depend on what type of pension you have. Mainly, there are four types of pension funds used to buy property. These are:

- Small Self-Administered Schemes (SSAS)

- Approved Retirement Funds (ARFs)

- Personal Retirement Saving Accounts (PRSAs)

- Buy-Out-Bonds

Small Self-Administered Schemes

These schemes are sometimes referred to as SSAS However, we will stay clear of acronyms and keep them simple.

Self-Administered pension schemes differ from traditional pension schemes in that you have the ability to determine both contributions and investment decisions. This is of course subject to certain restrictions.

Therefore, a self-administered scheme offers you a level of control over the direction of your investments. It also provides a wide range of flexibility with regard to your pension contributions.

Unlike some more typical pension arrangements, there are no obligations to make regular contributions. These types of schemes are often favoured by owners and directors of companies.

Importantly for this article, a self-administered scheme allows you to invest in direct property.

However, the IORPS ruling means there are restrictions. Only 50% of the fund is eligible to be invested in property.

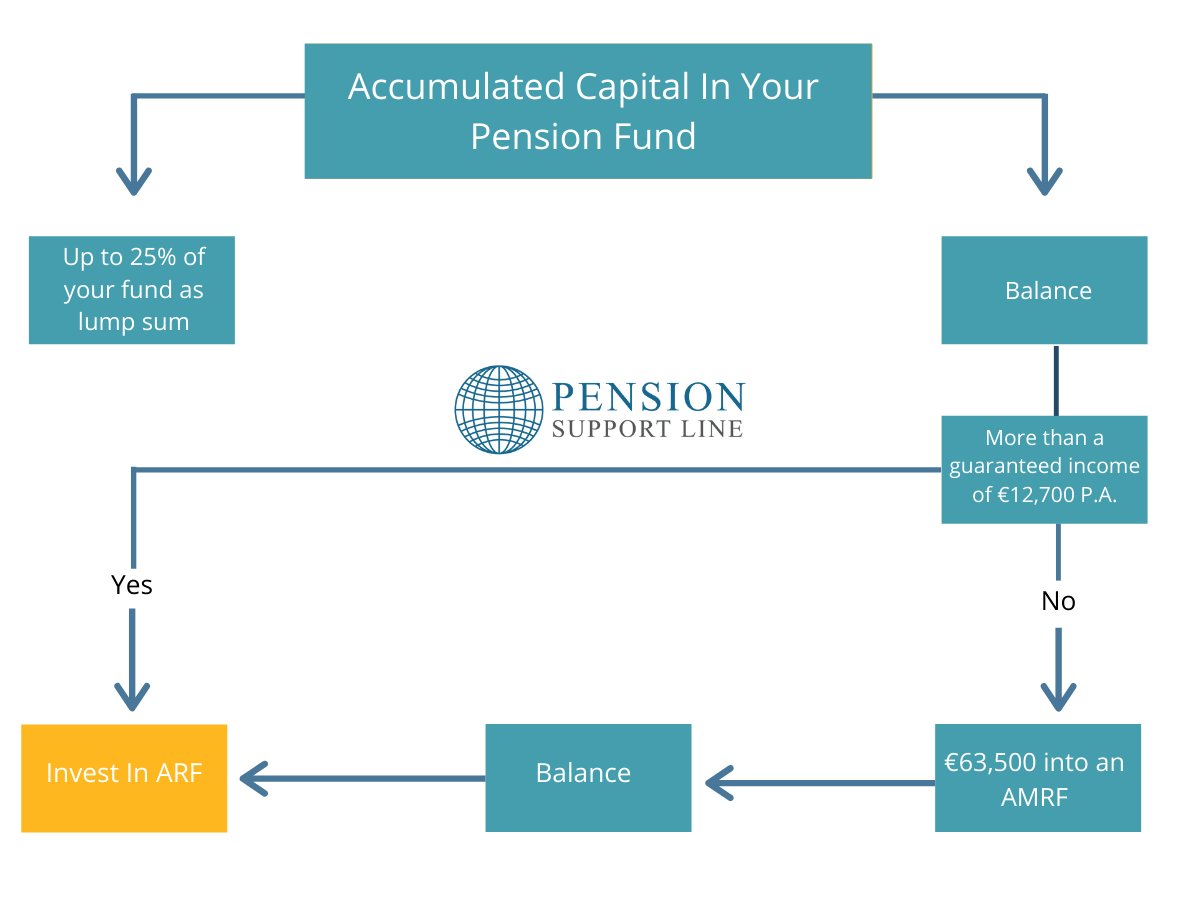

Approved Retirement Fund (ARF

An Approved Retirement Fund or an ARF as they are commonly known are a post-retirement vehicle.

An ARF will also give you a wide choice of investment options. It also allows you to invest all or part of your pension after you retire.

There are several advantages associated with an ARF. Flexibility is largely seen as an ARFs greatest advantage.

You may have the opportunity to invest in everything from quoted shares, corporate bonds, exchange-traded funds to property.

It is worth noting that there is quite a lot of legislation when it comes to investing your pension into property. Not all situations will be eligible.

If you would like to discuss using your pension to buy property, feel free to contact one of our team for a chat.

Rules When Using Your Approved Retirement Fund (ARF) to buy a property.

When using your ARF to buy a property, a certain amount of the total fund must be withheld as liquidity.

Often the liquidity is between 5-10% and is used to cover expenses. In some cases, there may also need to be a particular amount held back to cove imputed distribution.

Below we look at some examples and how much you may need in your ARF to buy a property.

| Price of Property | Liquidity Witheld (10%) | Total Amount needed in ARF |

| €300,000 | €30,000 | €330,000 |

| €450,000 | €45,000 | €495,000 |

| €600,000 | €60,000 | €660,000 |

| €720,000 | €72,000 | €792,000 |

In the above examples, we have assumed that the liquidy withheld is 10% of the total fund value.

This means if you are looking to purchase a property through your ARF you may need to leave some wiggle room.

Gearing is a possibility in some circumstances but it is best to discuss this with an advisor.

If you are wondering how much your may need, we have broken down the average house prices by town below.

Personal Retirement Savings Account (PRSA)

A Personal Retirement Savings Account or PRSA, is an investment account you can use to save for retirement.

You have the ability to make regular or lump sum contributions. This flexibility makes them attractive options for many people.

Should you have a PRSA, you may also have the ability to use this pension to buy a property.

It is worth noting that there are different types of PRSA’s. The two categories are:

Our guide to PRSA’s takes a more in-depth look at PRSA’s and what you may need to consider.

Buy-Out-Bonds

A Buy-Out-Bond is often referred to as a Personal Retirement Bond or PRB. More acronyms and jargon, the pensions industry just cannot help themselves. Often different phrases mean the same thing.

Either way, is a policy where you can transfer your pension fund should you leave a company pension scheme.

Again, a Buy-Out-Bond will give you the opportunity to use your pension fund to buy property.

Pension Property Process

Below is a rough guide to the steps you can expect when buying a property through your pension.

-

Assess your pension arrangement and your eligibility

-

Discuss potential options with your advisor

-

Find a suitable property you wish to purchase

-

Choose a solicitor to arrange the legal documentation

-

Your application will be processed

-

Ensuring your solicitor has arranged the relevant documentation and transfer of funds

-

Begin receiving the tax-efficient income from your investment property

Benefits of using your pension fund to buy property

Using your pension fund to buy property has many benefits associated with it. Not only is property seen as a ‘safe’ investment, many people like the idea of the bricks and mortar.

Property is a tangible asset, particularly when you purchase it outright.

Some of the benefits of using your pension to purchase a property are:

- You will have the flexibility to identify specific properties you feel would be a good fit. Therefore, you have the opportunity to use your own market knowledge to seek out opportunities.

- Many schemes can invest directly in residential and commercial property.

- If permitted, you may be eligible to borrow a percentage of the purchase. (restrictions permitting)

- Any costs associated with the purchase of the property are absorbed by the pension fund. For example, stamp duty or any solicitor fees.

- You will not be liable to any Capital Gains Tax (CGT) on the sale of the property.

- There will be no income tax liability on any income received.

Are there certain rules I should be aware of when using my pension fund to buy property?

There are various rules and stipulations if you are considering using your pension to buy property.

If we assume you have satisfied the relevant requirements and you pension qualifies, there are still further considerations needed.

If purchasing a property through your pension you must ensure the following:

- The vendor must remain at arm’s length from the owner of the pension arrangement. For example, you cannot buy the property and rent it to your wife, brother, sister or any other connected parties.

- The purpose of buying the property must not be to rent it to a connected party. Again, it must be at arm’s length.

- Purchasing of property with a view to development and resale is prohibited.

- Purchasing a holiday home for personal use is not permitted.

- The purchase of overseas property is only permitted in certain circumstances. There must be appropriate arrangements in place to enable the trustee to maintain control of the asset.

- Any rental payments must be paid into a bank account associated with the related scheme.

- Any work completed on the property must be carried out by an unconnected party.

As you see from the above, there are a number of regulations to be abided by should you wish to purchase a property through your pension.

If you do happen to purchase a property that is then used by a person or entity connected to you, it will be deemed to be a distribution from the pension arrangement and taxed accordingly.

There can be quite a lot of moving parts and many elements to consider. Our advisors have experience guiding clients through the process and would be happy to discuss any questions you may have.

Restrictions of using your pension to buy property

Although we can look at some of the restrictions in place when buying a property through your pension, we often still get asked similar questions.

Below we look at some of the common questions clients ask us.

What details of the property will be required?

If you intent to buy a property through your pension and satisfy the stipulations we touched on above, you will then be required to provide additional information such as:

- The purchase price of the property. This will need to be agreed upon with a contract signed by the relevant parties.

- If applicable, you may be asked to show proof that a deposit has been paid.

- The contact details of your solicitor or any relevant legal representatives.

Above are just some of the details that may be required. In certain circumstances you may be asked to provide additional information.

What are some of the costs associated with a property purchase?

It is always worth discussing any potential costs with your advisor from the outset. There are a lot of moving parts involved with purchasing a property with your pension.

Some of the costs you can expect to incur are:

- Solicitor fees

- Stamp Duty

- Insurance

- Letting agent fees

- Local property tax

Again, each situation is different and costs will vary depending on the property.

Can I live in the property I buy with my pension fund?

No.

As we touched on earlier, any property purchased through your pension must be at ‘arm’s length’. This means that anyone connected to the owner whether that be a person or entity cannot use the property.

Can I take a loan out to buy the property?

In some cases, yes a loan may be an option. This is referred to as gearing. However, this will be dependent on the type of pension you have.

| Pension Type | Is Gearing an Option |

| SASS | Yes |

| PRSA | Yes |

| PRB | No |

| ARF/AMRF | No |

As we see in the table above, eligibility for gearing will depend on your pension arrangement. If you are unsure whether you may qualify, it is best to speak with your advisor and assess all potential options.

How much will I need in my pension to buy a property?

This will be dependent on the value of the property you have in mind. However, it is not exact like for like situation.

For example, let us say you have €400,000 in your pension. It will depend on scheme rules but often that max value you can use to buy a property here will be 90-95% of the total fund value.

As we mentioned above, with an ARF, the remaining 5-10% is withheld to cover liquidity for expenses or in the event of no rent coming in. Often there will also need to be a certain number of years of the imputed distribution held back also.

If you would like to use your pension to purchase a property, it is worth discussing with an advisor to see if you are eligible.

Average housing prices across towns in Ireland

Below is an outline of the house prices across Ireland by individual towns. However, prices continue to fluctuate as we know so the below are constantly changing.

| National Average | €270,000 |

| Greystones | €495,000 |

| Letterkenny | €150,000 |

| Kinsale | €345,000 |

| Curragh | €300,000 |

| Kilkenny | €221,663 |

| Gorey | €234,000 |

| Dublin 5 | €404,000 |

| Dublin 8 | €335,250 |

(Source, CSO)

As we mentioned earlier, eligibility will be dependent on the type of pension arrangement you have. Feel free to contact our team if you have any questions. We can be contacted by phone, email, or our live chat.

How does retirement affect my pension?

As you get close to or enter retirement, this may have an impact on your pension. Perhaps you are looking at a post-retirement vehicle such as an Approved Retirement Fund (ARF).

An ARF gives you the option to invest your pension fund after you have taken your retirement lump sum. Many people then use their ARF’s to invest in property.

However, as with most elements of pensions and as we have seen above, there are often a lot of moving parts.

There are also issues around imputed distribution and liquidity that must be satisfied. These will be dependent on your pension arrangement.

Do I have to sell the property when I retire?

Again, your type of pension arrangement will likely make your decision for you. Should you have an ARF, you will need to satisfy the imputed distribution rules which states a portion of your fund must be taken each year.

This will be 4% from age 61 to 70 and 5% from age 71 onwards.

In a perfect scenario, the rental income you earn from your property would cover the imputed distribution.

Is buying property a risky investment?

As with most decisions we make in life, there will be a certain amount of risk attached. Deciding to invest in property is no different. Although, many do see it as a stable asset class.

The main asset classes used for investing pension funds are:

- Equities

- Bonds

- Property

- Cash

It will also depend on whether you are purchasing a property outright or if you are buying into a fund that invests in property.

If you are investing your pension into a particular fund, there is an EU risk rating scale.

As we touched on before, there are certain restrictions when it comes to using your pension to buy property. The type of pension arrangement you have will play an important role when it comes to eligibility.

Take time to speak with a qualified professional who can help you assess all potential options.

Don’t Get Left Behind!

Enjoy this blog?

We send out a short email every Thursday with some tips and information we think may be useful.

Join over 2,000 subscribers who enjoy our weekly tips!

Over to you!

The first step is to take a little time to do your own research. Although property can look like an attractive investment, it is important it is the right decision for you.

There is no one-size-fits-all approach when it comes to investing your pension. Your individual circumstances and situation should be taken into consideration.

Some rough steps to follow would be:

- Take time to research and understand your specific pension arrangement.

- Find an advisor who will go through the pros and cons of potentially using your pension to buy property.

- Take a holistic approach to the situation as a pension is likely only one piece of the puzzle.

- Review your pension arrangement at least once a year.

Any advisor worth their salts will insist on meeting and reviewing your pension arrangement annually. This gives you both the opportunity to discuss the performance of your investment and any changes that may have taken place.

Hopefully, this blog has provided you with more information and some clarity regarding how or if you can use your pension to buy property.

There are various rules and restrictions in place but for many, it can be an excellent investment. Although it is not without risk.

If you would like to assess your options, we offer a complimentary consultation.

During this consultation, you can ask any questions you may have and assess whether property could be an option for you. Most clients prefer a phone call at the beginning but a video call or in-person consultation are also options.

| info@pensionsupportline.ie | |

| Phone | 01 890 3518 |

| Video Call | https://calendly.com/pensionsupportline/pension-support-line |

| In-Person Meeting | Contact Our Team |

Assess Your Eligibility Today

*This blog should be used for information only and not taken as financial advice.