The State pension has received a lot of publicity in recent years. We are living longer than ever, and it is important you plan for your retirement. You have worked hard all your life and deserve the lifestyle you would like in retirement.

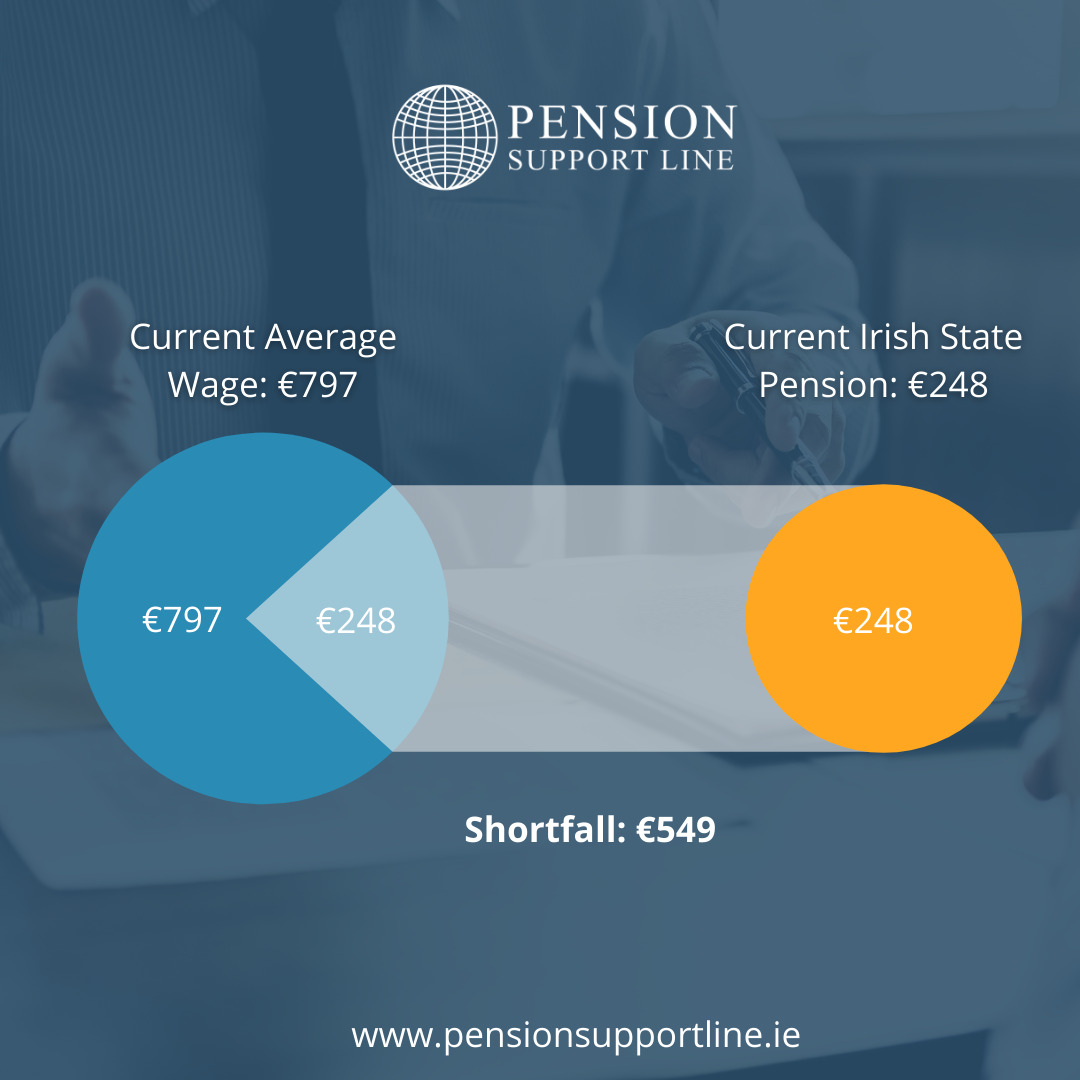

The current average wage in Ireland is approximately €41,000 which equates to roughly €797 per week. (Source: cso.ie).

The State pension is currently €248 per week. That leaves a shortfall of €27,500 per year or €549 per week.

However, it is never to late (or to early) to start planning for retirement. Why not book a consultation with one of our experts? We take a non-jargon approach to financial planning and can guide you through the process.

Start planning for your retirement today. A pension is a vehicle for tax efficient savings. You can get tax relief up to certain limits on pension contributions you make. For example, those 60 or over are eligible for tax relief at 40% (source: pensionsauthority.ie).

The State Pension in simple language is a social payment. Individuals from the age of 66 years and above can qualify for this support vehicle. Furthermore, this payment is based on your Pay Related Social Insurance (PRSI).

Have you ever worked in Ireland and paid PRSI contributions ‘stamps’ and 66 years of age? It is recommended that you should apply for the State Pension (Contributory).

Unlike other, social payments, this subsidy is not means tested.

What does this mean? A means test is simply a way of checking if your have enough financial resources to support yourself and if you require any social assistance. This does not apply to you!

The rate you receive is currently €248.30 per week. As this is not means tested, you will receive the total amount if you are eligible and no private pension you may have will tamper the amount.

This social payment is granted to you to fulfil your basic need upon retirement. This payment is liable to tax but if it is your only income it will be minimal.

Over 66 years of age or over

Started to pay PRSI contributions before the age of 56.

520 full-rate PRSI Contributions (10 years’ minimum contributions).

(If you turned 66 before 6 April 2012, you need 260 paid full-rate contributions)

You need:

An increase to the qualifying age to the state pension was set to be 67 in 2021 and to 68 in 2028. According to the budget 2021, the state pension will remain will continue to be 66.

| Yearly Average PRSI contributions | Personal rate per week | Increase for a qualified adult (under 66) | Increase for a qualified adult (over 66) |

| Age: 48 or 0ver | €248.30 | €165.40 | €222.50 |

| 40-47 | €243.40 | €157.40 | €211.40 |

| 30-39 | €223.20 | €149.80 | €200.50 |

| 20-29 | €211.40 | €140.10 | €188.70 |

| 15-19 | €161.80 | €107.80 | €144.50 |

| 10-14 | €99.20 | €65.70 | €89.50 |

| Yearly Average PRSI contributions | Personal rate per week | Increase for a qualified adult (under 66) | Increase for a qualified adult (66 and over) |

| 48 or over | €248.30 | €165.40 | €222.50 |

| 20-47 | €243.20 | €165.40 | €222.50 |

| 15-19 | €186.20 | €124.10 | €166.90 |

| 10-14 | €124.20 | €82.80 | €111.20 |

You can access your contribution statement through www.mygovid.ie. Here you will see exactly how many contributions you have made and any tax credits you are entitled to.

Well, it is pretty simple!

You can contact one of the below:-

We know Covid-19 is a major problem when trying to access your local office.

Here is a link to ‘Intreo centres and local branch office’ so you can find out any other relevant details, i.e. Contact details etc.

https://www.gov.ie/en/directory/category/e1f4b5-intreo-offices/

It is worth noting that, sources recommend that you should apply a couple of months before you turn the qualified age (66). If you have paid contributions in other Countries, it would be a good idea to apply even earlier.

The non-contributory state pension differs from the standard state pension as it is means tested. Those who do not qualify for the state pension (contributory) will be assessed for the non- contributory based on their insurance record.

Some of the rules to qualify are:

The means test will look at any cash income you may have. It will also look at savings and any property you may own. However, this will exclude your own home.

| Max personal rate | Increase for adult dependant age under 66 | Increase for a child dependant |

|

Age 66 but under 80 – €237 Age 80+ – €156.60 |

€156.60 |

Child under 12 – €36 (full rate) €18 (half rate) Child under 12 years or older- €40 (full rate) €20 ( half rate)

|