Planning to live on the State Pension alone, means you are also planning to live on €248 per week (€35 per day)

The Irish State Pension has been receiving increased media coverage in recent years. Perhaps the effects of a global pandemic made people realize everything is not as stable as it seemed.

More of us are looking at our long-term future and trying to ensure stability. Many people in Ireland struggled post-Celtic Tiger and no one wants to be in that position again.

Although pensions are universally seen as a smart investment and a good idea, we still have a low take-up rate in Ireland.

Although there are whispers of auto-enrolment similar to other countries, at best that is several years away.

Planning for retirement can never start too early. Relying on the State Pension as your sole income in retirement will be difficult. Starting a pension today could be one of the best decisions you make.

Your future self will likely thank you for it. Now, let us look at some interesting facts and figures about pensions in Ireland.

State Pension Statistics

Those who are age 66 and have enough PRSI contributions will qualify for the State Pension (Contributory). There is also a Non-Contributory State Pension which has different rules.

If you are planning to rely on either of these there are aspects you should consider.

Eligibility for the State Pension will depend on several factors. Below we’ll look at the pension system as a whole in more detail.

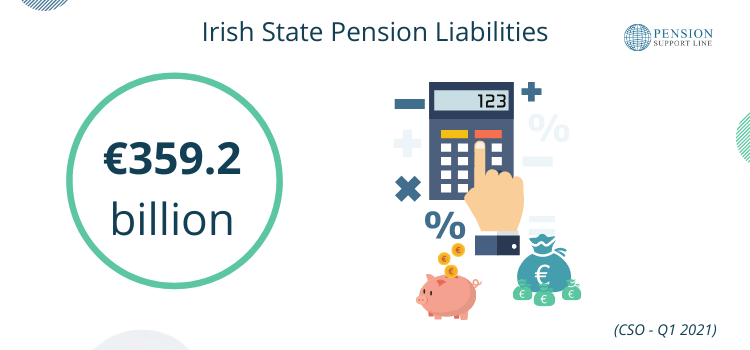

Liabilities

The current liabilities surrounding the State Pension would be the most worrying aspect. Ireland has an aging population meaning there will be a shortage of people to fund the liabilities in years to come.

As above, the latest findings from the Central Statistics Office show that State pension scheme liabilities amount to €359.2 billion.

If these are the current figures we can only imagine they will have risen significantly in 30 years.

How much is the State pension worth?

Your State Pension rate will depend on how many years of PRSI contributions you have made. The maximum rate for the State Pension Contributory is €248.30.

You will receive an extra €10 per week when you reach age 80. Other allowances might be made in special circumstances.

Inflation

Inflation is a silent killer you will have to consider if you plan to rely on the State Pension as a source of income. Any retirement planning should keep inflation in mind.

We have already looked at the fact we have a pension system with huge liabilities combined with an aging population. Considering both of these, it is unlikely the government will provide additional funding to increase the State Pension amount.

Therefore, it is likely €35 a day may be as good as it gets. If we think of what something cost ten years ago compared to today you will get a good idea of inflation.

Nowadays we see the prices of our favorite chocolate bar increase yet the bar decreases in size almost like magic. The costs of goods and services will continue to rise and your €20 today will not go as far in 2045 as it does today.

Is everyone eligible for the State pension?

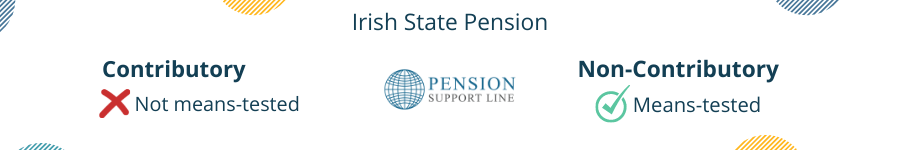

We are all entitled to some State Pension in one form or another. Whether you fall into the Contributory or Non-Contributory category.

Some of the requirements for eligibility are the following:

- You must be 66 or over and have enough PRSI contributions.

- You must have paid PRSI contributions before a certain age

There are several variables in play as no two situations are the same.

As we know, the State Pension is for those over the age of 66 who have enough contributions to qualify. The State Pension system consists of contributory and non-contributory.

Contributory State Pension

The contributory State Pension is not means-tested. This means you can have other sources of income such as personal or occupational pensions. You will still be eligible to receive a contributory pension.

Non-Contributory State Pension

The non-contributory pension is also a funded State Pension. However, it is means-tested for people aged 66 or older who do not qualify for the contributory State Pension based on their social insurance payment history.

Whether you are eligible for either the contributory or non-contributory is not the most pressing issue. At a maximum, you will receive €35 per day.

Considering you may still have bills or some outgoings in retirement, it will likely be a struggle to live on such a modest amount.

This is where having a private or occupational pension will pay dividends.

Irish Pension Statistics

Pensions have been trending in Ireland in recent years. Between companies, winding up Defined Benefit (DB) schemes and more employers offering group pension schemes it has received plenty of coverage.

Although Ireland does still have quite a low pension rate. Perhaps the thought of trying to live off €35 a day will eventually be enough to help people take the plunge.

Not only will it help your financial stability in retirement, but you also receive several benefits.

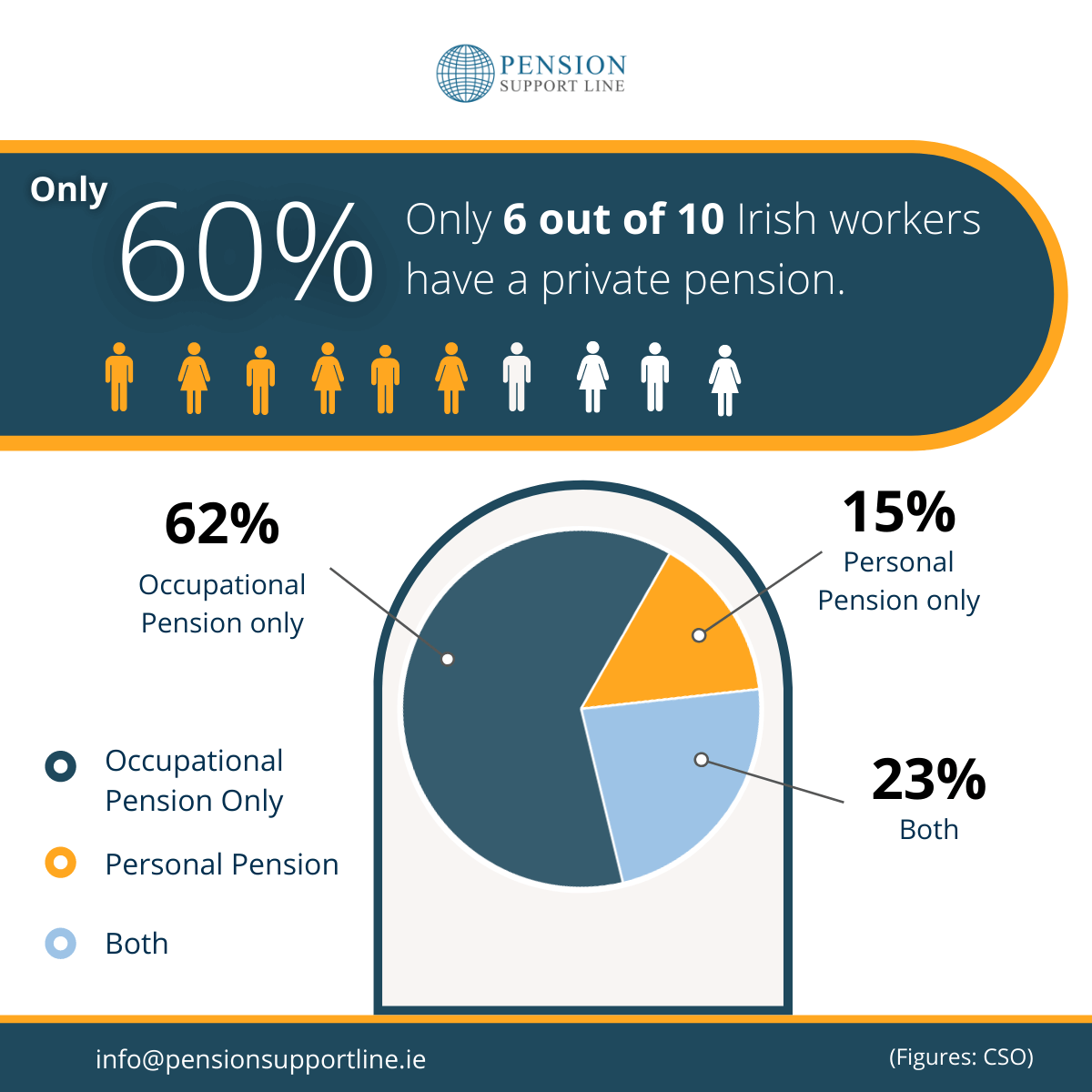

Number of people with private pensions

According to the Central Statistics Office (CSO), only 6 in 10 people in Ireland currently have a private pension.

A concerning outcome of the CSO study was that 37% of people simply said they have never gotten around to starting a pension. This is astonishing considering the benefits, as well as the fact it has never been simpler to start a pension.

Retirement Age

There is not a fixed retirement age in Ireland. However, it will likely be set out in your contract of employment.

As we know, you will be eligible for the State Pension from age 66. Some employment contracts will have a mandatory retirement age. Often this will be set at age 65.

Ireland’s aging Population

The fact we are living longer, healthier lives is great. Although, it does add pressure to systems such as the State Pension. Those extra years are costing the State hundreds of millions.

| Year | Population over the age of 65 |

| 2006 | 468,000 |

| 2041 | 1,400,000 |

The above study illustrates the significant growth of Ireland’s older population of those over age 65. Within 35 years there will be an additional 932,000 people nearing or in retirement.

With a State Pension system already carrying the burden of liabilities north of €300 billion, it would be a cause for concern.

Benefits of having a private pension

Having a private pension in place will be beneficial at retirement. It will help you enjoy the lifestyle you would like.

However, there are many specific benefits of contributing to a pension. These include:

However, if you have your pension sorted and are looking for additional ways to plan for retirement, the below may help.

Tax relief

As we work, we all have to pay taxes. Whether you are at the higher or lower rate, there is no escaping them. However, contributing to a pension has a unique advantage.

| 20% Tax Bracket 40% Tax Bracket | |||

| €100 | Total Investment Into Your Pension | €100 | |

| -€20 | Less Tax Saved | – €40 | |

| €80 | Net Cost To You | €59 | |

However, there are limits as to how much tax relief you can receive on contributions.

The amount you can contribute and receive tax relief will depend on your age. There are certain limits and thresholds in place.

| Age | Maximum % of earnings allowable for tax relief on pension contributions |

| Under 30 | 15% |

| 30-39 | 20% |

| 40-49 | 25% |

| 50-54 | 30% |

| 55-59 | 35% |

| 60 or over | 40% |

(The maximum earnings limit for contributions is €115,000) source: www.revenue.ie

For example, if you are 32 years old, you can contribute up to 20% of your salary and receive tax relief.

Tax-Free growth

Once in a pension, any investment growth will be tax-free. Your pension pot is free to accumulate over time free of any taxes.

You will be free from income tax, capital gains tax, DIRT, or any other taxes. It is worth noting you will be liable to income tax on the withdrawal of your pension. However, you will also receive a portion tax-free.

Living longer

As we live longer than ever before, you will want to enjoy those extra years in retirement. After retiring you will likely have 20+ years to tick off some of those bucket list items.

Unfortunately, without the help of a private pension or some savings, it will be difficult.

Compound interest

Anyone saving or investing long-term will be aware of the magic of compound interest. It has even been described as “the eighth wonder of the world” by Albert Einstein.

Compound interest helps your investment grow because, in addition to earning returns on the money you invest, you also earn returns at the end of every compound period.

There are plenty of free online tools where you can play around with compound interest calculations.

Tax-free cash at retirement

At retirement, you will be eligible to access part of your fund tax-free. Currently, you can take 25% of your pension fund as tax-free cash. This is subject to a lifetime limit of €200,000.

Any lump sum between €200,001 and €500,000 is taxed at 20%. Anything over this balance will be taxed at your marginal rate and subject to USC.

Could you live on the State Pension alone?

As has been a theme of this blog, the final benefit of starting a pension is the State Pension. Whether it is the mounting liabilities or the fact living on €248 is not appealing, depending on it as a sole source of income is risky.

Ideally, we would not have many outgoings in retirement. However, just because you retired does not mean your bills have.

Auto-enrolement

We have been hearing whispers about an auto-enrolment system over the past number of years. However, the Government’s plan to introduce mandatory private pensions for all workers above a certain income limit is looking further away than ever.

An auto-enrolment system would see employers introduce a workplace pension scheme and automatically enroll their employees into the scheme.

Slow progress combined with Covid-19 means we’ll probably be closer to 2025 than the original 2022 target when we see it introduced.

Without an auto-enrolment system in place, pressure will increase on the State Pension to support future retirees.

Statistics show that the auto-enrolment model is growing globally. It is being actively encouraged by the World Bank and OECD. Australia launched the programme many years ago with Israel and the UK following suit.

It is a model that will help bridge the retirement gap and allow people to save and plan efficiently for retirement.

How to start a pension?

Waiting for auto-enrolment to commence so you can start your pension would be ill-advised. The best time to start a pension is now. The pension industry can be full of jargon which is why we prefer to keep it simple.

Starting a pension is easier than ever before. We break it down into 7 simple steps. Once you’re happy with everything you will then have an annual review.

Any fees or charges should be shown upfront as transparency is key in an industry such as this. If your advisor is using acronyms or phrases you do not understand, just ask for everything to explain in simple English.

How much will I need in retirement?

Unfortunately, there is no universal answer when it comes to this question. Although, studies do show that many of us underestimate how much we’ll need in retirement.

We conducted our survey back in February, 2021. One of the questions was “how much do you think you will need in your pension fund to live the lifestyle you would like in retirement?”

On average, respondents stated they would like approximately €433,000 in their pension pot.

This is quite a significant gap compared to what the State Pension will provide.

Where to go from here?

While reading this blog you probably found some of the statistics surprising. It seems many people underestimate how much they will need in retirement.

It also appears that although the vast majority of people understand the importance of having a private pension, many still leave it on the long finger.

As we showed, the State Pension is under pressure. It has mounting liabilities of nearly €360 billion. We also looked at the fact Ireland has an aging population. This system will come under increasing pressure in the coming years.

If you are looking to enjoy retirement on more than €248 a week, a private pension should look like an attractive option.

We offer a complimentary consultation and would be happy to chat through any questions you may have.

We purposely take a non-jargon approach so there will be no acronyms or fancy terms involved. Feel free to contact our team today and take control of your retirement.

Email – info@pensionsupportline.ie

Book Your Free Consultation

*This blog should be used for information only and not taken as financial advice.