Client Case Study

Company A

Company A approached Pension Support Line in January 2021 regarding their Defined Contribution pension scheme.

There was a lack of transparency and communication with the company that originally set up their scheme.

They wanted someone who took a non-jargon approach to pensions. One of our advisors reviewed the scheme and found improvements that could be made.

The first port of call was to hold a zoom session with the employees. A jargon-buster style session answered questions such as:

Following this call, Company A received a lot of positive feedback, and employees are now much more comfortable going forward.

Client Case Study

Company B

Company B approached Pension Support Line following seeing an online advertisement. They had a company pension scheme in place a number of years but had not received regular correspondence.

The combination of the above meant a dramatic increase in the overall charges associated with the fund. Our advisor was also able to increase the allocation rate for those contributing to the fund.

It is important your company pension scheme is reviewed annually.

If your situation is similar to either of the above and you would like to assess your options, feel free to contact our team.

Did you know, 50% of employers now offer their employees the opportunity to join a company pension scheme?

A recent study shows that 93% of employees considered the ability to join a company occupational pension scheme a perk of the job (Matrix Recruitment, 2020).

Also, it is worth noting that 86% of those surveyed stated they would increase their contributions if their employer-matched them.

All company owners want their employees to be as happy as possible. When employees are content output and productivity rise.

Offering the ability to join a company pension scheme is a simple way of helping to keep your staff happy.

Our advisors have vast experience in setting up such schemes and can walk you through the process stress-free.

If you would like to discuss arranging a company pension plan, please arrange a complimentary, no-obligation consultation here.

Table of Contents

What is a company pension scheme?

Often referred to as occupational pension schemes, these plans are set up by the employer. These schemes provide an income after retirement for scheme members.

There are different types of company/occupational pension schemes. They may be: –

- Contributory – meaning both you and your employer will pay contributions towards the scheme.

- Non-Contributory – where you contribute but your employer does not.

There are also defined benefit and defined contribution or hybrid schemes which we go into more detail below.

How to start a company pension scheme?

Sometimes it can be difficult to know exactly where to start. Do not worry, we have helped companies across Ireland and have broken it down in a few easy steps.

Deciding which arrangement is best suited to your company is important. You want to ensure everything is compliant and the scheme suits your business.

Our advisors will help you through the process step-by-step. We will also assist in engaging staff and dealing with those who join or retire.

Having experience in this process will make it as seamless as possible for your business. Contact our team today to discuss setting up your company pension scheme.

How are company pension schemes operated?

Company pension schemes or occupational pension schemes are often set up under trust. This means that the schemes assets are looked after by trustees on behalf of the members.

There are different types of members within a company pension scheme. These are:-

- Active members – these are members currently in service (still working in the employment).

- Deferred members – those who were members but have since left the employment.

- Pensioners – Those who are retired and in receipt of a pension.

In most company pension schemes; trustees do not carry out the day-to-day running of the scheme.

Often a financial broker or life insurance company will look after the scheme.

However, trustees must appoint a registered administrator to carry out certain functions relating to the scheme.

Regardless of who is looking after the day-to-day operating of the scheme, trustees are still responsible for ensuring members can access information regarding the scheme.

It is important you keep in regular contact with whoever set up your company pension scheme. You should also receive an annual review.

If you have a company pension scheme but are looking to have it reviewed, book your complimentary consultation here.

Our advisors operate and manage over 60 corporate schemes across Ireland.

Are company pension schemes compulsory?

Employers in Ireland are not legally obligated to provide a pension scheme for employees. However, this should not stop you from exploring this option.

Although no obligation to set a company pension scheme, employers must give all employees access to a PRSA.

A Personal Retirement Savings Account is individually owned and lets you save for retirement even if no occupational scheme is in place.

It is the employer’s duty to facilitate a PRSA through the payroll system so employees can avail themselves of the benefits.

Are company pension schemes contributions tax-deductible?

Yes. As an employer, you can receive tax relief on contributions made to the pension arrangement. How these contributions are treated for tax purposes will depend on the type of arrangement you have.

Employer contributions to pension arrangements are fully deductible for corporation tax purposes up to certain limits.

Contributions paid by employers to PRSAs are treated as a benefit-in-kind but income tax relief is provided. It is worth noting that employer contributions to PRSA’s are not subject to PRSA or USC.

Let us look at an example and break it down.

Niamh pays tax at 40% and contributes €200 per month which is then matched by her employer. The net cost of a total pension contribution of €400 per month is just €120.

| Monthly Contribution | Benefit in Kind | Tax Relief | Net Cost | |

| Employer | €200 | |||

| Employee | €200 | €0 | €80 | €120 |

| Total | €400 | €120 |

Types of company pension schemes

There are various types of occupational or company pension schemes. We have broken each down in detail below: –

Defined Benefit pension scheme

A defined benefit (DB) scheme is where the benefit entitlement is defined and directly correlates with your earnings, length of service, an index, or fixed amount.

This type of scheme is also referred to as a ‘final salary scheme’.

Essentially, you can calculate in advance what your pension will be. It will provide a set level of pension in retirement.

For example, it may be half of your final salary if you have 30 years’ service which will be a certain amount each month.

Defined Contribution pension scheme

Defined Contribution (DC) schemes have a set contribution level for both the employee and employer.

It is a fixed agreement where the final benefits will be based on the value of the fund built up through contributions.

It is worth noting, the fund value may fluctuate over time according to the performance of the relevant fund choices.

In simple terms, this means you will not know exactly what pension you will get.

Let us look at an example. Both you and your employer pay regular contributions of 5% of your salary. These contributions will create the pension fund and accumulate over time.

This fund is then invested to try and ensure it is not devalued and keeps up with inflation.

Hybrid pension scheme

As we seen above, within occupational pension schemes you can offer both defined benefit and defined contribution schemes.

A hybrid scheme is neither a full DB nor DC scheme. It is a blend and has characteristics of each.

There are several different variations of hybrid schemes. If you would like to discuss any in more detail, please book your complimentary consultation.

Group PRSAs

A Group PRSA (Personal Retirement Savings Account) is different from other group pensions as Group PRSAs are individually owned- contracts.

Our advisors can offer your employees a wide range of fund choices. However, not everyone would like to decide what fund choices they pick.

Therefore, we can also operate using a default strategy.

What makes a successful company pension scheme?

There is not a standardised answer as to what makes a successful company pension scheme.

However, there are certain traits and characteristics that often lead to having an efficient company pension scheme.

Some of these characteristics are: –

- Member Engagement – Engagement with anything is key and your company pension scheme is no different. If you as the employer can fully buy into understanding the benefits of having such a scheme, it will carry a lot of weight. It will encourage employees to engage and become members of the scheme.

- Scheme Governance – Our advisors can work alongside you to ensure the scheme is fully compliant. With experience in managing company pension schemes across Ireland, we can help you with any governance issues that may arise

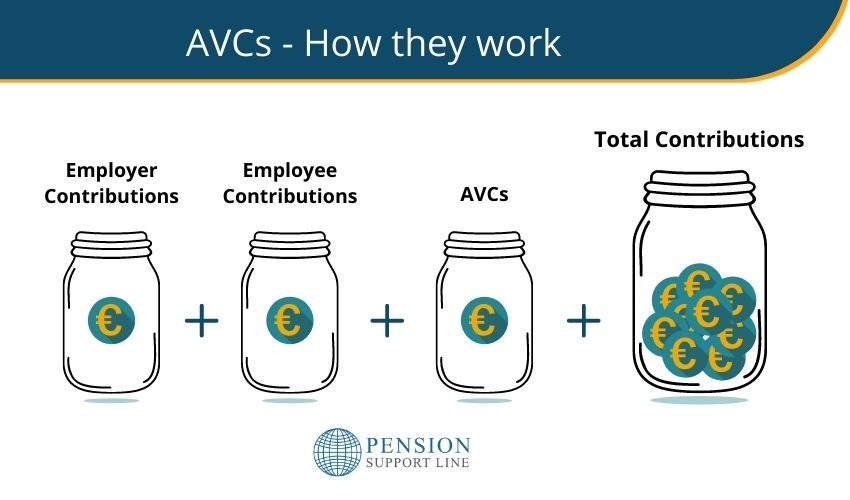

Can I make Additional Voluntary Contributions (AVCs)?

AVCs are additional contributions you have the option of making to increase your retirement benefits.

AVCs can be made along with your normal contributions to occupational pension schemes. This can be done in both public and private sector pension schemes.

Your fund at retirement will be a combination of both your contributions along with any investment returns from these contributions.

You are permitted to choose the rate at which you contribute. However, these will be subject to a maximum in accordance with Revenue limits.

It is also worth noting that AVCs will only be permitted if allowed to do so under the scheme rules.

Also, should you die as a defined benefit member, your spouse may be entitled to a 50% payment.

Alternatively, with a buy-out-bond, the entire sum would pass to them.

How are my pension contributions invested?

Your options will most likely differ depending on what scheme you are in. If you are a member of a defined contribution scheme, you may be provided with a choice of investment options.

However, choosing an investment strategy should not be taken lightly. You should always consult an expert before making regarding how your pension is invested.

On the other hand, if you are a member of a defined benefit scheme, often your contributions will be invested on your behalf.

Tax relief on pension contributions

Pensions provide us with a tax-efficient way of saving for our retirement. You will receive income tax relief against your pension contributions.

These contributions are calculated on age-related thresholds. See below for each threshold and its related tax relief:

| Age | Percentage of earnings |

| Under 30 | 15% |

| 30-39 | 20% |

| 40-49 | 25% |

| 50-54 | 30% |

| 55-59 | 35% |

| 60 and over | 40% |

The contributions made are eligible for tax relief up to a maximum of €115,000

Source: www.citizensinformation.ie

Benefits of a company pension scheme.

Having a company pension scheme can offer many long-term benefits to your organisation. Some of the main benefits of having a company pension scheme are:

-

- Attract Key Employees – Having efficient, reliable employees will be a key factor in your organisation’s success. If you do not acquire employees with the traits you desire, your business will likely suffer.

With studies showing that 93% of employees considering a company pension as a perk, having one in place will go a long way to hiring the employees you would like.

2. Increase Employee Loyalty – Having a solid company pension plan will also reduce the turnover of employees.

With a competitive job market, having a retirement plan for employees is key. If certain benefits and perks are not provided, current employees will start to look at alternative arrangements with better long-term benefits.

Recent studies show the cost of replacing an employee can cost on average between 6 and 9 months salary.

If we use Ireland’s average wage in this example, that is approximately between €18,500 – €27,000.

3. Tax Benefits – Employer contributions to company pension arrangement are fully deductible for corporation tax within certain limits.

4. Competitive Advantages– With 50% of companies in Ireland offering a company pension scheme, it means another 50% are not.

If your business is offering retirement planning to potential employees, it may give you an edge over your competition. This in turn will allow you to attract the best employees and grow your business.

Group Risk

Your employees are the most important aspect of your business. Without them, the business would not exist. Therefore, it is important to protect them.

Employees value the proposition of having an employer who is willing to invest in protecting their future.

Group Life Insurance

Having Group Life Assurance Cover provides employees with a benefit of death in service. This can be in the form of a lump sum payable to a particular beneficiary, spouse, or civil partner.

Group Income Protection

This allows you to provide a continuing source of income to replace the salary of employees unable to work due to illness or injury.

This will be paid to employees who are unable to work for a sustained period.

Group Critical Illness Cover

This cover will pay-out a lump sum to an employee on the diagnosis of a serious illness as outlined in the policy.

The benefit is paid once the employee has survived for a set period.

How can I find out how my pension is performing?

If you are an active member of a company pension scheme, you should be receiving an update annually.

This update will come in the form of a document called an ‘annual benefit statement’.

If you have not received any correspondence regarding your scheme, contact your employer or HR department and make a request.

Do I need to review my current company pension scheme?

Have you currently a company pension scheme in place?

Do you feel you are not getting the service you deserve?

Are you aware of the management fees and charges associated with your current company pension scheme?

The world is more fast-paced than ever and pensions are no exception. They are always changing as well as the legislation that governs them.

You do not have to get into the nitty-gritty of day-to-day running of your scheme. However, it is never a bad idea to have it reviewed.

If you would like one of our advisors to review your current pension scheme, please book your complimentary consultation.

Our advisors take a hands-on approach. This means you will get the service you deserve. We also provide annual reviews and meet with any employees who would like to do so.

How do I review my company pension scheme?

Our advisors will undertake a full review of your current pension arrangement. If there are certain areas that may be improved upon you can then assess your options.

You can have your company pension scheme reviewed in these 4 easy steps.

Speak to a pension transfer expert

Our advisors work alongside Irelands leading life insurance companies. Ensuring you get access to funds that suit you best.

Pension transfers can be a difficult area to navigate. Pensions can seem confusing, but they don’t have to be.

With the right advisor by your side, you can enjoy the retirement lifestyle you deserve.

If you are considering transferring your pension it is important you seek professional advice before making any decisions.

Contact our team today on 01- 890 3518 or email us at info@pensionsupportline.ie