Start Your Pension Today

The pension industry is full of acronyms and starting a pension can sometimes be daunting.

However, the process of starting a pension has never been easier.

We have many clients who approach us in their 50’s looking to start a pension. Some are at a stage in life where they are looking to invest some disposable income.

As a greater number of people are now starting to avail of the benefits a pension offers, starting a pension at 50 would still give you 16 years of tax relief and tax-free growth.

As we live longer, healthier lives than ever before, more and more people are starting their pension later in life.

Luckily, there is no right or wrong age to start a pension.

Are you 50 or approaching it and considering your options?

One major benefit you will have is the ability to contribute 30% of your income while receiving tax relief should you choose to do so.

The number of people with private pensions in Ireland has continued to rise year on year and will likely do so for the foreseeable future. If you would like to discuss potential options, feel free to contact our team.

How to Start a Pension?

Step 1: Understanding how pensions work

Step 2: Meeting with a financial advisor

Step 3: Assessing the different pension options available

Step 4: Fact-finding process

Step 5: Risk assessment

Step 6: Select an investment strategy that is suitable to your needs

It is also important that you take time to review your pension annually alongside your financial advisor.

What types of pensions can you start at 50?

Personal Retirement Savings Account (PRSA)

This is a personally owned pension that can be taken out regardless of employment status.

Self-Employed Pensions

Our clients include both self-employed and sole traders assessing their options.

Company Pension Schemes

We help small-medium size businesses set up or review their pension schemes.

Benefits of Starting a Pension at 50

Tax Relief on Contributions

Starting a pension at 50 gives you the ability to contribute up to 30% of your gross salary while receiving income tax relief. This is up to a maximum annual limit of €115,000.

Tax Free Growth

Should you start your pension at 50, you will receive a minimum of 16 years of tax-free growth on your pension fund.

Tax-Free Lump Sum

At retirement, you will often be eligible to take a percentage of your fund tax-free. The amount you take will be dependent on the type of arrangement you have and if you have taken lump sums from other pensions.

Most people will be eligible to take 25% tax-free as a lump sum. However, there is a limit of €200,000 that can be taken tax-free

Starting a pension at 30,40 & 50

Starting a pension at 30

Starting a pension at 30 will give you approximately 37 years to save for retirement. Plenty of time to enjoy tax-free growth and tax relief on your contributions.

Learn MoreStarting a pension at 40

Starting a pension at 40 means you are slightly closer to retirement. Although you can contribute up to 25% of your salary subject to conditions.

Learn MoreStarting a pension at 50

Being in your 50's does not mean it is too late to start a pension. Our advisors can walk you through the process and answer any questions you may have.

Learn MorePension Tax Relief Benefits

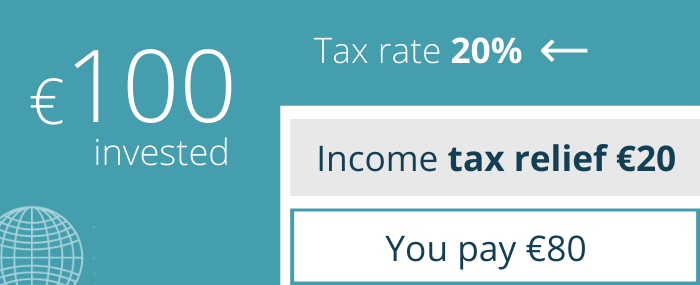

If you are on the tax rate of 20% and invest €100 per month you will receive tax relief of 20% by Revenue.

If you are on the higher tax rate 40% and invest €400 per month you will receive tax relief of 40% by Revenue.

Calculation Example: 1

Pauline | Salary – €55,000

| Age | 50 |

| Salary (gross) | €55,000 |

| Retirement age | 66 |

| Target pension as a percentage of current salary | 50% (€27,500) |

| State Pension | €12,912 p.a. |

| Shortfall | €14,588 |

Please note – the above calculations are based using assumptions and figures from the Central Statistics Office around life expectancy in Ireland and should not be taken as advice.

If you are looking to calculate how much you may need in retirement, we offer a complimentary consultation with an advisor. This can be done online, over the phone, or in person.

| Amount needed per year | Amount of years | Total |

| €14,588 p/a | 16 | €233,408 |

As we see from the above, there will be a shortfall of €233,408. This is including the assumption that Maura receives the full State pension.

Calculation Example: 2

Patrick | Salary – €65,000

| Age | 50 |

| Salary (gross) | €65,000 |

| Retirement age | 66 |

| Target pension as a percentage of current salary | 50% (€32,500) |

| State Pension | €12,912 p.a. |

| Shortfall | €19,588 |

Please note – the above calculations are based using assumptions and figures from the Central Statistics Office around life expectancy in Ireland and should not be taken as advice.

If you are looking to calculate how much you may need in retirement, we offer a complimentary consultation with an advisor. This can be done online, over the phone, or in person.

| Amount needed per year | Amount of years | Total |

| €19,588 p/a | 15 | €313,408 |

As we see from the above, there will be a shortfall of €313,408. This is including the assumption that Maura receives the full State pension.

As we get older, our salary generally increases. As we reach retirement age, many of us will be on a much higher salary than when we started our careers.

Therefore, you will need more in your pension to be able to sustain the lifestyle you would like. The cost of standard of living is also something that must be taken into consideratio.

In order to keep things simple, we have ignored inflation during our calculations. However, it is something to discuss with your advisor.

Your money will be worth a lot less in 10 years than it is today. It is a silent killer that will eat into your savings if it is not accounted for.

How do I pay my pension contributions?

As you contribute to your pension, you will be eligible for income tax relief against your earnings.

However, the amount you can contribute while receiving relief directly relates to your age.

There are specific thresholds that change depending on your age. From age 50-55, you can contribute 30% of your earnings and be eligible for relief.

However, the maximum earnings that can be considered in a year are €115,000.

| Age | Percentage limit |

| Under 30 | 15% |

| 30-39 | 20% |

| 40-49 | 25% |

| 50-54 | 30% |

| 55-59 | 35% |

| 60 or over | 40% |

Planning to rely on the State Pension?

A plan to rely on the State pension could prove to be a costly move. It is a system with liabilities of €359 billion.

Ignoring its liabilities and assuming it remains into the future, it will still put you in a position where you are living on €35 a day.

Any bills or basic outgoings will eat into this without leaving much behind. This is where having a private pension in place becomes hugely important.

Starting a pension will allow you to plan appropriately and enjoy the retirement lifestyle you would like.

Start Your Pension at 50