You do not need to be a Qualified Financial Advisor to understand Approved Retirement Funds (ARF). Or ARFs, as they are commonly known.

However, understanding ARFs and how they can be invested will allow you to gain flexibility with your investment.

It will be your retirement money you are investing so it is probably a good idea that you have some knowledge and understanding.

Our advisors have over 100 years of industry experience and specialise in retirement planning and ARF investments.

Table of Contents

I am approaching retirement, what are my financial options?

As you approach retirement it can be a busy and sometimes stressful period. You are making plans for your financial future and will most likely have some important decisions to make.

However, having a good advisor by your side and planning in advance will help alleviate some of the stress.

Depending on your pension arrangement, you will probably have various options available. You are probably eying up that tax-free lump sum and wondering what you’ll do with the rest?

Well, according to Revenue rules and provided you meet certain criteria, you may use the remainder of your fund in the following ways:

- Purchase an annuity – This is a regular guaranteed income for the rest of your life.

- Re-Invest your finds in an Approved Retirement Fund and or an Approved Minimum Retirement Fund.

- Take as a taxable cash lump sum subject to PAYE rules. (Also known as a Trivial option)

Do not worry, we will into what these acronyms mean in just a minute!

What is an ARF?

An ARF in an investment fund that allows you to invest your pension after you have taken your retirement lump sum.

ARFs are appealing as they give you control over how your fund is invested. It also gives you the options of a wide array of different fund options.

However, it is advisable to consult an expert before deciding to invest in your ARF. We can do a lot of research, but a second opinion is always a good idea.

There are rules surrounding withdrawals from your ARF. Most of these are regarding the minimum amount you must withdraw each year.

These minimum withdrawals are referred to as imputed distribution. We will break this term down in further details in a couple of minutes.

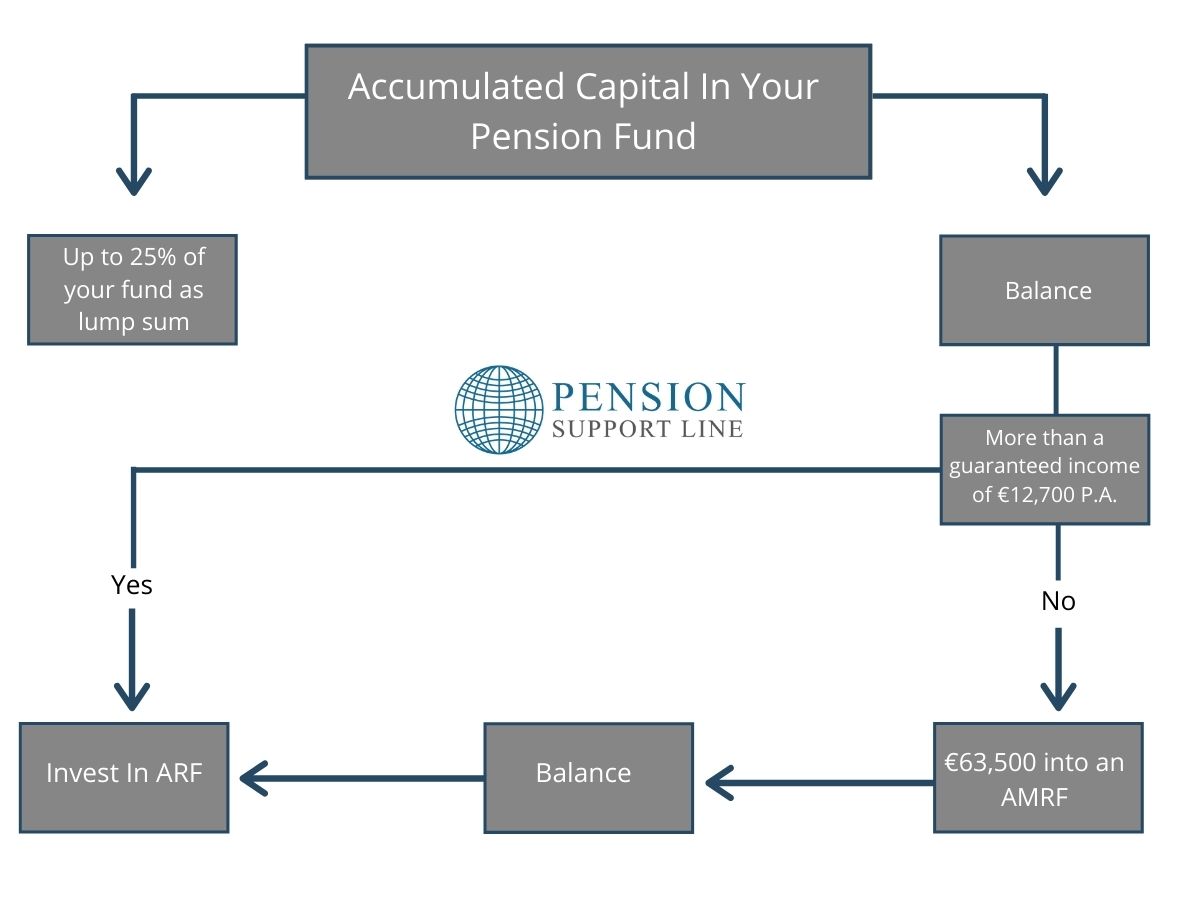

However, certain conditions must be met before you can invest your ARF. These conditions are:

- You must be in receipt of a guaranteed income for life of at least €12,700.

(It is worth noting that rent is not seen as guaranteed income) - You must have invested a minimum of €63,500 of your retirement fund into an AMRF or purchased an annuity.

A lot going on there, we know. Time to breakdown what is an AMRF and its conditions.

What is an AMRF

An AMRF is like an ARF but has some key differences. It is a separate fund for those who: –

- Do not have a guaranteed annual income of €12,700 &

- Have not invested in an AMRF or purchased an annuity.

Unless you have satisfied both the above conditions after taking your retirement lump sum, you are not eligible to invest your funds into an ARF.

This can be quite a lot to get your head around.

Think of an AMRF as Revenue’s way of ensuring you have a ring-fenced amount for your retirement.

They do this by enforcing certain rules surrounding how much you can with from your AMRF annually. The max you can withdraw per year is 4%.

You cannot withdraw any larger than this until age 75 or you satisfy the €12,700 guaranteed income rule.

However, it is worth noting that you are not required to take a minimum withdrawal from your AMRF each year, even from age 61.

Approved Retirement Fund (ARFs) - Explainer

What are the advantages of an ARF?

As with anything in life, there are pros and cons. This is particularly the case with financial products.

We spent some time researching some facts and figures by various accreted financial advisors. Here are some of the advantages of ARFs we found: –

- Flexibility, you can have as much control of your investment as you would like.

- You can decide when and at what rate you would like to withdraw from your ARF. (minimum of 5% from age 61)

- Growth within your ARF is tax-free, however, it is worth noting that withdrawals from your ARF are taxable.

- On death, the full value of your fund will pass to your spouse. If they die, your ARF crystalizes and passes to your estate (30% tax).

- You have the option to purchase an annuity at a later date if you feel the rates may increase.

What are the disadvantages of an ARF?

Time to look at some of the potential disadvantages of choosing the ARF option.

- Your fund is not guaranteed and may underperform and fall in value.

- Your ARF fund could eventually run out during your lifetime. The amount of income you withdraw will have an effect or a combination of this along with investment returns being less than expected.

- Some ARFs ongoing charges are quite high. (This is where finding a good advisor will come in handy).

- Imputed distribution could eat into your ARF and the amount could eventually run out.

As mentioned above, we aim to give you a full 360-degree view of various potential scenarios.

Hopefully, we did not scare you away too much.

However, it is always important to find a good financial advisor before jumping into any decisions.

What is an Annuity?

An annuity provides you the option of a regular income for the rest of your life, no matter how long you live.

You may have the option of purchasing an annuity with the money in your pension fund.

The amount in your pension fund is directly correlated to the annuity you can avail of. The more money in your pension fund, the higher your annuity income will be.

However, it is vital to seek help from your financial broker before deciding between an annuity or an ARF.

Annuities come with some variables and depending on your situation may or not be the correct decision for you.

ARFs or Annuity?

So, we have gone through explaining what is an ARF? We also looked at some advantages and disadvantages.

However, after taking your retirement lump sum you may also have the option of

purchasing an annuity.

These two have some key differences which mainly are down to flexibility and risk.

An annuity will give you a guaranteed income payable for the rest of your life. However, on death, you face the risk of little or no return for dependants.

With an annuity, the agreement is a fixed amount of annual income once you decide to purchase the annuity.

There is no opportunity for growth as it is fixed and a decision to purchase an annuity cannot be reversed.

If you decide to purchase an annuity there is no going back. Again, always get some expert advice before jumping into any of these decisions.

However, ARFs also have some drawbacks which we spoke about above.

Essentially, the decision to go for an ARF vs an annuity should be judged on a case-by-case basis and take your particular set of circumstances into account.

What are the withdrawal options for an ARF?

As we know by now, once you have satisfied the relevant rules and are in receipt of your ARF, you have got flexibility.

You can essentially withdraw from your ARF as regularly as you would like. However, this should also be done with caution.

The last thing you would want is to bleed your fund dry.

However, you must be also aware of what is called ‘imputed distribution’.

Imputed distribution is a mandatory withdrawal of a particular percentage from your ARF or Vested PRSA. This withdrawal is subject to income tax, PRSI, and USC and must be taken at least once per year.

Imputed distribution breakdown

| Age | Minimum withdrawal percentage per year |

| 61 | 4% |

| 71 | 5% |

It is important to note that where the total fund value is more than €2 million that withdrawals will be 6% from age 61 as per pension legislation.

As with any investment, nothing is guaranteed. Your ARF fund may run dry at some stage.

Can I cash in my ARF?

If your funds are currently in an ARF, this means you have demonstrated you have a guaranteed income of €12,700 per year at a minimum.

Once these rules have been satisfied, you may access your ARF funds. An ARF is a post-retirement vehicle that gives you flexibility and allows you to invest your pension fund.

However, any decision to make an invest with your ARF should only be done so with the help of an expert. If you have an ARF an are considering investing it click here to book your complimentary consultation.

Can I invest my ARF?

An ARF gives you the ability to invest your fund to suit your attitude to risk.

It also gives you a wide range of investment choices.

You have the opportunity to invest in everything from quoted shares, corporate bonds, exchange-traded funds to property.

However, there are certain restrictions and pension legislation must be adhered to.

This is where having an advisor experienced in investing ARFs is vital.

European Risk Rating

European Union law requires that all life companies use a scale that indicates the level of risk for each of their funds.

Here we have designed a graphic to illustrate how these scales operate.

In Ireland, this scale ranks from numbers 1-7. This helps investors to compare the risk associated with various funds.

However, it is worth noting one thing. Although the numbers used are universal, companies may take different factors into account when gauging volatility and risk.

This is why it is vital you consult an expert who understands your risk profile and attitude to risk.

Our risk profiles often change with age so it is something that should be reviewed.

Can I contribute to my ARF?

No. ARFs are a post-retirement product designed to give you an income in retirement. You can invest or withdraw but not contribute further to the fund.

However, it is possible to transfer into your ARF from existing pension arrangements.

What happens to my ARF when I die?

A little bit morbid, but this is an important factor for many.

On death, due to the fact with an ARF you own the retirement fund, you can leave the funds to your spouse, civil partner, and/or beneficiaries when you die. An ARF left to spouse or civil partner can be transferred to their name and be tax-free.

Any withdrawals from then on will be liable to income tax, PRSI, and USC as per pension legislation.

It is worth noting that should you leave your ARF to anyone other than the above, they may be liable to on capital acquisitions tax or income tax depending on the situation.

| ARF inherited by | Income tax liability | Capital acquisitions tax liability |

| Transferred ARF in name of surviving spouse | No. | No. |

| Directly by surviving spouse (not transferred to ARF) | Yes. | No. |

| Children (under 21 years) | No. |

Yes. Capital acquisitions tax at 33% (As per thresholds) |

| Any other person | Yes. |

Yes. 33% tax to all amounts above the relevant threshold. |

** Thresholds can be found at www.revenue.ie**.

Importance of having a long-term plan

Having a long-term financial plan can allow you the opportunity to plan for and enjoy the things you like in retirement.

However, everyone has different needs so there is no one-size-fits-all financial plan. Particularly in the world of pensions where there are various rules and regulations, having an experienced financial advisor can be worth their weight in gold.

If you would like to assess your options and to begin to take control of your retirement please leave your information below.

How can I prepare for retirement?

There are many factors to consider when planning for retirement. Ensuring you are financially stable is a priority for many as they approach retirement.

However, this should not be a stressful period of your life. With the correct long-term financial plan in place, you can plan the lifestyle you deserve.

There may be various pension options available to you and deciding what is best can be overwhelming. Our advisors have 100 years of combined industry experience and can assist you and ensure you understand any decision you make.

As life expectancies increase, we can look forward to a long, active retirement.

Whether you are retired or approaching retirement, we can help you. Having a concrete financial plan in place for your retirement will allow you freedom and flexibility.

Experienced Qualified Financial Advisors

We work alongside a team of industry experts who have over 100 years of combined industry experience.

These expertise combined with a non-jargon approach will ensure you make the right decisions. Also, any decision you do make you will fully understand. Book your consultation today and being to plan for your retirement.