Pension contributions give you the opportunity to not only save for the future but also to do so in a tax-efficient way. None of us enjoy paying tax so this is a match made in heaven.

A combination of tax relief on contributions, tax-free growth, and a lump sum at retirement make pension contributions an attractive option.

However, there are different limits and thresholds when contributing to a pension. In this blog, we analyse how pension contributions work and what is the maximum pension contribution allowable.

What is a pension contribution?

A pension contribution will form part of your pension scheme. This is a long-term savings plan that allows you to save for the future.

Most pension plans allow you to contribute regularly or as a once-off lump sum. The amount you have in your pension fund by retirement will be a combination of your contributions.

You can set up a pension plan through the insurance companies directly or many people decide to use a broker. There are also different types of pension plans available which we will look at in more detail below.

Limits on tax relief on pension contributions?

Unlike a regular savings account, money contributed to a pension plan is eligible for tax relief. This means that for every contribution within the limits, you will receive a tax break.

This tax relief directly correlates with your income tax bracket. The tax relief you receive will be at your marginal tax rate.

For example, if you pay 40% income tax, you will receive 40% tax relief. If you pay 20% income tax, you will receive 20% tax relief on your pension contributions.

| 20% Tax Bracket | 40% Tax Bracket | ||

| €100 | Total Investment Into Your Pension | €100 | |

| -€20 | Less Tax Saved | – €40 | |

| €80 | Net Cost To You | €60 | |

Below we look at this with some real-life scenarios.

Example 1 – Michael | Salary – €30,000

| Salary | €30,000 |

| Pension Contribution | €200 per month |

| Net Cost | €160 |

Example 2 – Pauline| Salary – €50,000

| Salary | €50,000 |

| Pension Contribution | €400 per month |

| Net Cost | €240 |

As we see from our example above, the effect of tax relief can dramatically reduce the net or ‘real’ cost of your pension contributions.

However, there are limits as to how much you can contribute while still receiving tax relief.

Maximum pension contributions thresholds

As with most things in life, there are limits, and pension contributions are no different.

These limits are directly related to your age. The thresholds allow you to contribute a higher percentage as you get older.

| Age | Maximum percentage of taxable earnings allowable for tax relief on your pension contributions |

| Under 30 | 15% |

| 30-39 | 20% |

| 40-49 | 25% |

| 50-54 | 30% |

| 55-59 | 35% |

| 60 and over | 40% |

(source : Revenue)

Total limit of pension contributions

It is worth noting that there is a maximum limit of contributions allowed while receiving tax relief. The current limit is €115,000 per year.

Example of tax relief on pension contributions

Below we will look at an example to better understand how different age brackets receive a different level of tax relief on pension contributions.

For simplicity in this example, we will take a person who earns €100,000 per year with no other income.

| Age | Maximum percentage of taxable earnings allowable for tax relief on pension contributions | Cost after tax relief |

| Under 30 | 15% | €15,000 |

| 30-39 | 20% | €20,000 |

| 40-49 | 25% | €25,000 |

| 50-54 | 30% | €30,000 |

| 55-59 | 35% | €35,000 |

| 60 or over | 40% | €40,000 |

The above table shows the impact your age will have on your ability to contribute while receiving tax relief. We used €100,000 for this example. However, the figures are interchangeable once it is below the €115,000 threshold.

The government does not want the whole population relying on the State pension. For this reason, there are many incentives to contribute to a pension, and tax relief is one.

Ideally, we will have the ability to contribute more of our income towards our pension as we get older. This is the thought process behind increasing the limits as we become older.

We are also more likely to be more conscious about our pension as we approach retirement and therefore more likely to contribute a higher amount.

What is the average pension contribution in Ireland?

Figuring out the exact pension contribution in Ireland can be difficult as there are so many variables.

However, we do know figures for what is the average pension in Ireland. Results from our survey showed the average pension is approximately €90,000.

If we assume we will contribute to our pension for roughly 30 years, that equates to €3,000 per year. This breaks down to €250 per month.

| Pension contribution | €250 |

| Tax relief (40%) | €100 |

| Actual cost | €150 |

As we see above, a contribution of €250 will in fact only cost €150 after tax relief.

It is worth noting it is difficult to get an exact figure on average pension contributions but the above illustrates how they work and the tax incentives available.

Average employer pension contributions

In Ireland, many companies have a Defined Contribution (DC) pension arrangement in place. This allows both employers and employees to contribute to the pension.

The Defined Contribution model has replaced the Defined Benefit (DB) model in many cases. However, surveys from the Irish Association of Pension Funds show that employers are becoming increasingly more generous with their contributions.

Below are some of the findings:

- 8% of employers are now contributing more than 15% of salary.

- In almost 50% of all new DC schemes, the employer is at least matching the employee contribution.

- 86% of those surveyed said the employer contribution rate was greater than 5%.

These results highlight the importance of a pension structure both to employers and employees.

Having a pension structure in place that includes employer contributions is key to attracting and retaining staff nowadays. This will likely only increase in importance into the future.

How much should I contribute to my pension?

There is no one-size-fits-all answer to this question. It will depend on your personal circumstances. As we saw above, age often plays a huge role. The type of pension arrangement will also be an important factor.

However, many people have a rough idea of what they would like to have in retirement. Unfortunately, the reality does not always match this figure.

How much you will need to retire will depend on many factors. We have written a blog on this topic in detail which should give you a guideline.

Different types of pension schemes

The amount you contribute to your pension will likely depend on what type of pension arrangement you have.

There are several different types of pension arrangements. These consist of various arrangements within both personal and occupational schemes.

Occupational pension schemes

For example, you may be part of an occupational pension scheme. This may consist of the following:

- Defined Contribution (DC) pension scheme – This is where both yourself and your employer contribute to your pension. What often happens is that your employer will match your contribution. For example, you both contribute 5% of your salary for 10% total.

- Defined Benefit (DB) pension scheme – These schemes are slightly different There is no calculation of contributions per say. Factors such as salary and years of service are considered which then calculate a lump sum/pension at retirement.

Personal pension schemes

As a PAYE employee or a self-employed person, you have different pension options available.

- Executive Pension Plans – These pension arrangements are set up by a limited company for the benefit of company directors or employees.

- Personal Retirement Savings Account (PRSA) – A Personal Retirement Savings Account (PRSA) is a personally owned pension that gives you the opportunity to save for retirement. You have the ability to contribute whenever you like on a regular or irregular basis.

- Personal Pension – A Personal Pension plan is a personally owned pension held in your name. These types of pension plans are often popular among self-employed sole traders. They are also available to those with no access to an occupational pension scheme.

It is worth noting that all of the above will be eligible for income tax relief or can be offset against corporation tax depending on the specific arrangement.

Are pension contribution limits the same for different types of pensions?

No. In some circumstances, different arrangements change the maximum contribution limit. For example, the contribution limits on Executive Pension Plans are significantly greater.

This is an important factor when deciding on your pension arrangement and structure.

Executive Pension Plan - Maximum Contribution Thresholds

Below we see the maximum contribution thresholds for Executive Pension Plans. These are far greater than in personal pension arrangements.

| Age | Percentage of Salary – Male | Percentage of Salary – Female |

| 30 | Up to 72% | Up to 67% |

| 40 | Up to 108% | Up to 100% |

| 50 | Up to 216% | Up to 200% |

| 55 | Up to 432% | Up to 400% |

It is worth noting that there is also a difference in maximum contribution levels allowed between male and females.

Pension Pension Plan - Maximum Contribution Thresholds

Personal pension plans have lower maximum contribution thresholds. Although, these do increase alongside age.

| Age | Maximum percentage of taxable earnings allowable for tax relief on your pension contributions |

| Under 30 | 15% |

| 30-39 | 20% |

| 40-49 | 25% |

| 50-54 | 30% |

| 55-59 | 35% |

| 60 and over | 40% |

Pension Contributions for the Self Employed

As a self-employed individual, you will have two choices with regard to a pension. The are the following:

- Personal Pension

- Personal Retirement Savings Account (PRSA)

Both of these have the same threshold with regard to contribution limits.

| Age | Maximum percentage of taxable earnings allowable for tax relief on your pension contributions |

| Under 30 | 15% |

| 30-39 | 20% |

| 40-49 | 25% |

| 50-54 | 30% |

| 55-59 | 35% |

| 60 and over | 40% |

The maximum amount of earnings taken into account for both of the above while receiving tax relief is €115,000.

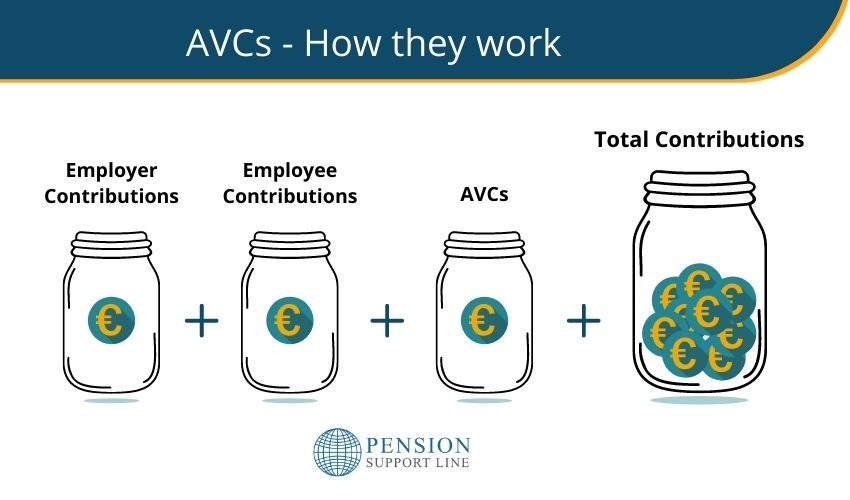

How do Additional Voluntary Contributions work?

Additional Voluntary Contributions (AVCs) are extra contributions made by a member of a group pension scheme in order to increase their benefits at retirement.

If eligible, you will receive tax relief on these contributions.

AVCs are usually made by members who feel the benefits they will receive at retirement may not be sufficient.

How to make an Additional Voluntary Contribution

Any member of a pension scheme has the ability to make an AVC. Once you decide on an amount, complete the relevant paperwork and submit it to your payroll department.

The AVCs are deducted directly from your salary. This means you will get full tax relief at the source.

AVCs are a popular choice for those working in the public sector. Some feel the benefits they will receive at retirement are not sufficient and would like to top up their pension fund.

Advantages of contributing to a pension

There are many benefits to contributing to a pension arrangement. Without mentioning the government incentives, it will give you the ability to enjoy the lifestyle you would like in retirement.

You will also have the opportunity to take advantage of the magic of compound interest as your fund accumulates over time.

However, there are three key advantages to contributing to a pension which are:

Tax Relief on Pension Contributions

As we have seen, your contributions to your pension will be eligible for tax relief. This means the ‘real’ cost of your contributions is lower.

The higher your income bracket, the higher rate of tax relief you will receive. For example, if you pay 40% income tax, you will receive 40% tax relief on your pension contributions.

| 20% Tax Bracket | 40% Tax Bracket | ||

| €100 | Total Investment Into Your Pension | €100 | |

| -€20 | Less Tax Saved | – €40 | |

| €80 | Net Cost To You | €60 | |

The government provides these tax breaks to encourage us to save for the future. How much you contribute will depend on how much you need in retirement.

This number will vary depending on your personal circumstances and the lifestyle you would like to live.

Tax-Free Growth

Another major incentive to contribute to a pension is the fact your fund will grow tax-free. This means it will accumulate over time free of income tax, capital gains tax, or DIRT.

Avoiding these taxes which are currently at 33% can have a huge impact on your fund level.

Tax-Free Lump Sum

The main attraction most of us associate with pensions is the ability to access a lump sum at retirement.

This means you can take a portion of your fund completely tax-free. The amount you can take will depend on the type of arrangement you have and any other lump sums you may have taken in the past.

Most people are eligible to take a 25% tax-free lump sum. Although, there is a limit of €200,00 that can be taken tax-free.

Once above this limit, there are thresholds that apply as we see below.

| Lump-Sum Amount | Tax Rate |

| Up to €200,000 | 0% |

| €200,0001 – €500,000 | 20% |

| Over €500.000 | Taxpayers marginal rate |

If you are considering taking a tax-free lump sum, it may be worth enlisting the help of an advisor to consider all potential options.

At what age can I access my pension lump sum?

The type of pension arrangement you have will play a role in when you can access your lump sum. Some arrangements allow you to access it earlier than others.

Below we have broken down the eligibility by age and pension arrangement.

| Pension Type | Age you can access benefits from |

| Defined Benefit (Occupational) | 50 |

| Defined Contribution (Occupational) | 50 |

| Personal Pension | 60 |

| Personal Retirement Savings Account (PRSA) | 60 |

| Executive Pension | 60 |

In certain circumstances, you may be able to access benefits earlier. Although this is quite rare and is usually only due to ill health.

What is the maximum threshold on pension funds in Ireland?

There is a maximum lifetime limit on the amount of retirement benefits you can have from all sources. It is worth noting that this does exclude any State pension benefits.

This lifetime limit is the Standard Fund Threshold (SFT).

The Standard Fund Threshold is the limit on the total capital value of pension benefits that an individual can draw from tax-relieved pension arrangements which come into payment for the first time after 7th December 2005.

The current Standard Fund Threshold is €2 million. However, if an individual exceeds this €2 million threshold, they may apply for a Personal Fund Threshold (PFT) in advance of their retirement.

The original Standard Fund Threshold was set at €5 million. However, this reduced to €2.3 million in 2011.

It was then further reduced to €2 million in January 2014. If an individual has benefits which exceed a capital value of €2 million, the excess will be subject to 40% tax liability.

How to start contributing to a pension today?

It has never been easier to set up a pension and start contributing. There is the option of completing the process digitally should you wish.

However, it is still important you speak to an advisor before taking the plunge. Each of us have different circumstances and there may be factors that need to be taken into consideration.

We offer the ability to start a wide range of pension arrangements such as:

- Personal Retirement Savings Account (PRSA)

- Self Employed Pensions

- Company Pension Schemes

- Executive Pension Plans

We help clients in a wide range of pension planning. If you would like to discuss your options feel free to contact our team.

From what age can I start contributing to a pension?

You can start a pension from any age once you are over 18. Obviously the earlier you start the better. However, starting is the most important thing.

We have broken down guides for those looking to start contributing to a pension at different ages.

No matter what age you start, you will have the opportunity to take advantage of the benefits pensions have to offer.

How much do I need to retire in Ireland?

How much you will need to retire will vary drastically from person to person. Some people may be happy living a modest life while others might prefer an extravagant cruise around the Mediterranean.

As a general rule of thumb, 50% of your gross pre-retirement salary is a good starting point.

Our survey showed that most people would like approximately €433,000 in their pension pot at retirement. This may seem like a large amount but spread over a 20-25 year period it is only €17,320 per year.

The amount you will need to retire will also depend on what age you plan on retiring. If you retire earlier and your income stops, you will likely need a larger amount to be financially secure.

We have written an in-depth blog analysing how much you need to retire at various ages. However, below is an overview:

| How Much Do I Need to Retire in Ireland? | |

| Retiring at 55 | €596,482.38 |

| Retiring at 60 | €486.022.68 |

| Retiring at 65 | €169,170.94 |

It is worth pointing out that the above is based on assumptions. Each individual will have different needs and circumstances. Always enlist the help of a financial advisor before making any decision regarding retirement.

What’s next?

We have looked at the maximum pension contributions and how the limits and thresholds are put in place.

Hopefully, you now have a better understanding of what options are available. The type of pension arrangement you choose is important.

Contributing to a pension is a tax-efficient way to save for retirement. However, no two situations are the same and each should be judged on an individual basis.

Whether you are a PAYE worker, self-employed, or a company director, different options will be available. Choosing the correct option for you is what is important.

We offer a complimentary consultation as pension planning is nuanced and it is important that the fit is correct for both us and you.

If you would like to discuss your options, feel free to contact our team.

We hope this blog has provided clarity and we look forward to hearing from you.

Pension Support Line Team

| info@pensionsupportline.ie | |

| Phone | 01 890 3518 |

| Video Call | https://calendly.com/pensionsupportline/pension-support-line |

| In-Person Meeting | Contact Our Team |

Don’t Get Left Behind!

Enjoy this blog?

We send out a short email every Thursday with some tips and information we think may be useful.

Join over 2,000 subscribers who enjoy our weekly tips!

Assess Your Eligibility Today

*This blog should be used for information only and not taken as financial advice.