Many people who are self-employed and operating as sole traders spend a lot of their time juggling several tasks and focusing on growing their business.

Unfortunately, retirement planning and pensions are often some of the things that fall through the cracks.

It probably does not help that the pension industry is full of jargon and acronyms. This just adds to the hesitation and confusion that surrounds many people when they hear the word ‘pension’.

However, speaking to the correct advisor and ensuring that you have a concrete plan in place should be a priority. The last thing you would want is to spend all those years working hard to not have the retirement lifestyle you would like.

Particularly as we know starting a pension has several tax benefits.

Studies show that the average pension in Ireland is approximately €90,000. This may sound okay but if we look at the average wage being over €40,000 that is only a couple of years salary for most.

At Pension Support Line, we also conducted our survey and found on average people would like €433,000 at retirement. That leaves a significant gap between what we would like and the reality in most cases.

Self employed pension options:

Personal Pension Plan

A Personal Pension plan is a personally owned pension that is held in your name. These types of pension plans are often popular among self-employed sole traders. They can however be organised by employed people who do not have access to an occupational pension scheme.

It is a product suited for those saving for retirement. Although, they are mainly popular among the self-employed. Choosing this plan will give you a wide range of investment options to suit your risk appetite.

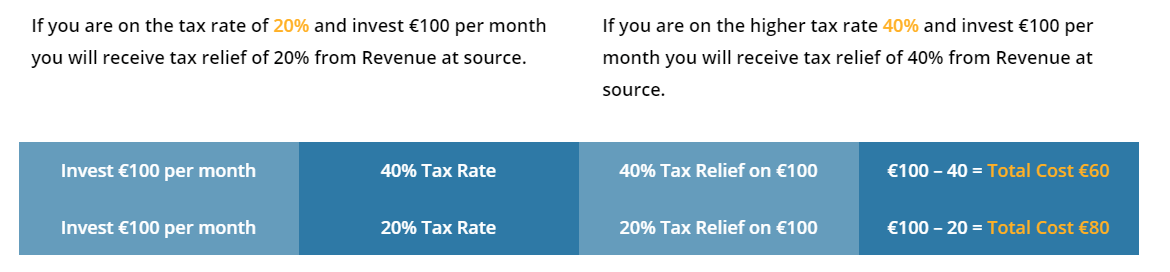

You will be eligible to receive tax relief on your pension contributions at your marginal tax rate whether that be 20% or 40%.

Any potential fees or charges should be transparent from the beginning before starting a policy.

Personal Retirement Savings Account (PRSA)

A Personal Retirement Savings Account (PRSA) is a pension arrangement that allows you to save for retirement in a flexible manner.

They are relatively straightforward to set up and any decent advisor can guide you through the process seamlessly. It is a popular choice among self-employed sole traders due to its flexibility.

You will have the ability to decide how much and how frequently you would like to contribute. As with a personal pension, you will be eligible for tax relief.

There are two types of PRSA:

- Standard PRSA

- Non-Standard PRSA

There are some key differences between the two. We compiled a PRSA guide to help our clients understand how they work.

The main difference between the two types of PRSA is the charges and investment options.

Standard PRSA

In a Standard PRSA, there is a maximum charge of 5% on any contributions. A maximum 1% charge of the fund value is also in place. Standard PRSAs can invest in pooled funds, also known as managed funds. However, temporary cash holdings are exempt.

Non-Standard PRSA

In a Non-Standard PRSA. There are no maximum limits on charges and you can invest in pooled funds as well as others.

Most sole traders will opt for the Standard PRSA option. It will likely cover your investment needs and means you will not be subject to heavy charges.

If you would like to look at any of the benefits of a PRSA in more detail you can check out our blog.

PRSA vs Personal Pension

PRSAs and Personal Pensions share a lot of similarities and are both an option for sole traders. However, they do have some differences such as:

- With a PRSA an employer can contribute.

- PRSAs have statutory charges whereas personal pensions do not.

Below we look at the two types of pensions and compare them directly in different aspects.

| PRSA | ||

| Flexibility | Contributions to your PRSA can be stopped at any time. As with a Personal Pension, you have the option to make one-off contributions. A PRSA will also give you flexibility should you change employment. | |

| Fund Choices |

You will have several fund choices available to you. These choices will be influenced by factors such as:

A combination of the above along with speaking with your financial advisor will help you decide. |

|

| Charges | All pension arrangements will have some related fees and charges. With a PRSA, your charges will largely depend on whether you have opted for a standard PRSA or non-standard | |

| Suitability | Anyone is eligible to take out a PRSA regardless of your job or employment status. It is a personal plan you can take out with any authorised PRSA provider. Its flexibility with regard to increasing or reducing contributions is what attracts many self-employed people. |

| Personal Pension | ||

| Flexibility | With a Personal Pension, you have the option of regular contributions or making a one-off contribution. You will also have the option of stopping contributions for a period of time known as a ‘payment holiday’. This flexibility makes them an attractive option for sole traders. | |

| Fund Choices |

|

Whether you go with the PRSA or Personal Pension option, your fund choices are likely to be similar. Your investment options are likely to include the following:

If you are unsure of anything, a regular review will add clarity. |

| Charges | There are various examples of how fees and charges can affect your fund performance. What seems trivial can have a dramatic effect on your fund over time. | |

| Suitability | Revenue describes Personal Pension Plans as those that are organised by individuals or self-employed without access to an occupational pension scheme. This is why they are so popular among self-employed sole traders such as plumbers, project managers, solicitors among many others. |

Benefits of a Self Employed Pension Plan

There are various benefits to having a pension plan in place. Not only will it allow you to appropriately plan retirement, but you will also get incentives along the way.

Tax Relief

Tax-Free Growth

Tax-Free Lump Sum

Tax relief on contributions

You will be eligible for tax relief on contributions made to your pension. The amount of relief you are entitled to will depend on your income tax bracket. If you pre-paying PAYE at a higher rate, you can claim 40% tax relief on all contributions.

This means if you put in €60 the government will add €40 giving you a €100 total. So instead of paying the €40 in tax it goes into your pension.

Tax-free growth

Another advantage is that once in a pension, your investment will grow tax-free. It will accumulate over time free of income tax, capital gains tax, or DIRT.

Avoiding all these taxes will save you a huge amount in the long run. As a self-employed person, any tax savings are always welcomed.

Tax-free Lump Sum

At retirement, you will often be eligible to take a percentage of your fund tax-free. The amount you take will be dependent on the type of arrangement you have and if you have taken lump sums from other pensions.

Most people will be eligible to take 25% tax-free as a lump sum. However, there is a limit of €200,000 that can be taken tax-free.

| Lump-Sum Amount | Tax Rate |

| Up to €200,000 | 0% |

| €200,0001 – €500,000 | 20% |

| Over €500.000 | Taxpayers marginal rate |

As we see in the table above, there are certain thresholds when it comes to taking your tax-free lump sum.

If you are considering accessing your pension it is always a good idea to consult an advisor. Pensions can be tricky and you want to ensure you make the correct decisions after assessing all potential options.

| Age | Amount qualifying for tax relief |

| Under 30 years | 15% |

| Age 30-39 | 20% |

| Age 40-49 | 25% |

| Age 50-54 | 30% |

| Age 55-59 | 35% |

| Age 60 or older | 40% |

(source: www.revenue.ie)

There is also a limit of maximum earnings allowable for tax relief of €115,00 per year. As we see in the table above, the relief increases as you get older.

Retirement Planning

Having a private pension in place is one of the most effective ways to plan for retirement. A pension is something most of us acknowledge we should have.

However, particular as someone busy running your own business, it can be easy to add to a long list of tasks. Although, the best time to start a pension is today. The earlier the better and you will avail of the benefits we outlined as well as the magic of compound interest.

Our study showed that most Irish people underestimate how much they will need in retirement. Planning to live solely on the State Pension is a risky move.

On average, respondents said they would like to have approximately €433,000 in a pension at retirement. The reality is that the average pension in Ireland is around €90,000.

| Average Pension (respondents said they would like to have) | €433,000 |

| Actual Average Pension in Ireland | €90,000 |

| Gap | €343,000 |

As a self-employed person, it is important to plan for the future. You will likely spend years putting everything into your business so having a solid plan in place will allow you to enjoy the retirement you deserve.

Can you live on the State Pension alone?

Whether you choose the PRSA or Personal Pension option, both will aid you financially in retirement. A staggering 4 in 10 people in Ireland have no private pension in place.

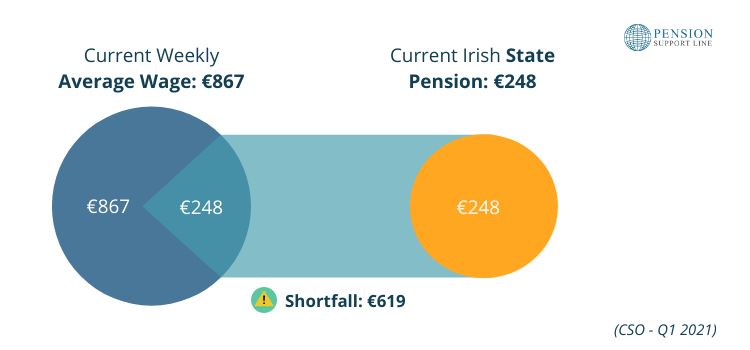

This figure might not seem too bad. That is until we look at what this 40% of people plan to rely on. The current State Pension is a modest €248 per week.

Compare that to the current average wage and it is a weekly gap of €596. This is going to leave nearly half the population of Ireland with a substantial shortfall in retirement.

Whether we look at these figures daily, weekly, or yearly, the figures do not get any better.

Ireland’s Average Wage vs the State Pension

| Average Wage | State Pension |

| Daily – €123 | Daily – €35 |

| Weekly €867 | Weekly €248 |

| Yearly – €45,084 | Yearly – €12,896 |

The above helps illustrate the gap some people will have when they retire. With no pension in place, it may be difficult to continue to live as normal.

This is without mentioning the current liabilities of our State Pension system. It is nearly €360 billion euro in debt.

The government is aware of this which is why they are pushing as much of the population as possible to start private pensions. If you are a self-employed sole trader, it is important to look after yourself and plan for the future.

We have heard whispers of an auto-enrolment pension system but with Covid-19 it is unlikely that will be in the near future.

Importantance of reviewing your pension

Unfortunately, simply starting a pension is not enough. It is not something you forget about until you reach retirement.

There are a number of reasons this is a bad idea, least of all it will be near impossible to know how much is in your pension pot. If you do not know how much you have how can you hit your desired goal?

There are certain aspects that will affect how much is in your overall pension pot. Although fees and charges can seem trivial, they can have a dramatic impact over time.

Always make time to discuss your pension at least once a year. This will allow you to chat with your advisor and ensure you keep on track.

What happens to my pension if I die?

If all goes to plan, your pension will be one of your largest assets. Therefore, it is important to understand how or if it can be inherited.

Whether you have a Personal Pension or a PRSA, the rules will be similar.

Inheritability of a Personal Pension

If you have a personal pension and die before benefits are taken, the full value of the plan is paid gross to your estate. An alternative option is the fund could be used to provide a spouse’s pension.

The tax implications will be as follows:

- Spouse – No tax implications.

- Children -Inheritance tax may apply depending on the amount and thresholds.

- Cohabitating Partner – May be liable to tax implications depending on the amount and thresholds.

You can find more specific information on inheritance and tax liabilities on Revenue

Inheritability of a PRSA

Similar to a Personal Pension, should you die before your retirement benefits are taken, the full value of your PRSA is paid gross to your estate.

You will also have alternative options of a spouse’s pension.

As per above, beneficiaries will be liable to inheritance tax. Although there will be no tax liability between spouse’s or civil partners.

If you have a Vested PRSA, it will be treated the same as an ARF on death.

Pension Term Assurance

Everything we have discussed during this blog was geared towards helping you safely plan for retirement.

Even if you decide not to go down the pension route, having protection in place is vital. As a self-employed person, it is up to you to fend for yourself. Having a pension term assurance policy in place will allow you to provide for your family should something happen to you.

In the event of your death, you know your family will be taken care of financially. You can also avail of tax relief on your contributions.

At what age can I access my pension?

The age at which you can access your pension will depend on the scheme type and rules associated with that scheme.

Defined Contribution (DC) and Defined Benefit (DB) schemes can sometimes be accessed from age 50.

However, PRSA’s and Personal Pensions are accessible from age 60. At age 60, you will likely be eligible to receive 25% of your fund tax-free.

As per revenue rules, this 25% tax-free sum is up to a lifetime limit of €200,000.

How do I set up a pension?

Luckily, it is simpler than ever. We have written blogs with an in-depth breakdown but overall it is a simple process.

You can set up your pension with a quick chat over the phone or a video call. Alternatively, you can arrange to meet with an advisor and go through some of the details.

The steps will include the following:

- Discussing your options with your advisor (over the phone or in-person)

- Completing a fact-finding process

- Completing a risk assessment

- Selecting an investment strategy

- Starting your pension

- Annual reviews

Ensuring your pension is reviewed annually will help you keep on track with any targets you may have. Any fees or charges will also be outlined from the offset.

End of year accounts

As a self-employed person, you are likely scrambling to have your accounts wrapped up by the end of October. Therefore, this is an ideal time of the year to look at contributing to a pension.

None of us are too fond of paying lots of our hard-earned cash in taxes. A pension will give you the opportunity to reduce the tax your paying while simultaneously helping you save for the future.

We already discussed the tax benefits and savings that can be made. Avail of our free consultation and discuss what option suits you best. We have helped countless self-employed clients across the country.

What to do now?

If you have read this blog you’ll be well aware of the benefits of pensions to the self-employed and sole traders.

Retirement likely feels like a lifetime away. However, the reality is that without a private pension in place, you run the risk of living off the State Pension. We know €248 a week does not get you much in 2021, it will get even less in 2041.

Inflation will eat into it. That is without mentioning a State Pension system with current liabilities of almost €360 billion. These liabilities also show no sign of slowing down.

Take advantage of the tax benefits and incentives by starting your pension today.

Book Your Free Consultation

*This blog should be used for information only and not taken as financial advice.