It is worth starting this blog by outlining that trying to avoid inheritance tax is not something we are advocating for. However, there are ways to potentially reduce your inheritance tax bill which is what we will discuss in detail.

Unfortunately, inheritance tax is something that we often do not consider before it is too late. It is also likely to come at an already stressful time in your life.

However, there are measures you can put in place to reduce your potential tax liabilities.

The Irish Government collected €522 million in 2019. This was from €1.6 billion in assets. Now, please do not switch off thinking this is a tax that only affects the wealthy.

This is a tax that affects everyone from your ‘average Joe’ up to the super-wealthy.

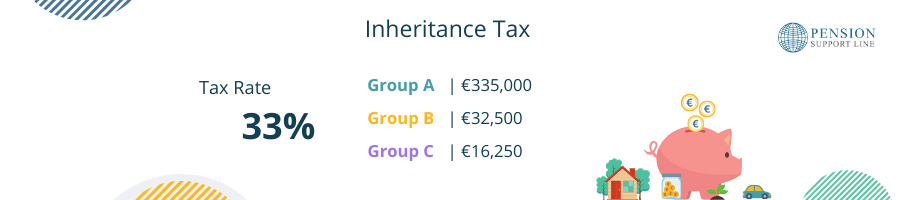

Anything inherited by a son or daughter over the value of €335,000 will be liable to inheritance tax. The thresholds are even lower for other relationships, but we’ll get to that.

Anything above these thresholds will be liable to a 33% tax payment.

For example, the average house price in Dublin is €412,000. This means many who inherit a house from their parents will have a tax liability.

This guide deals with how inheritance is treated and the tax implications after death when assets are being passed.

However, in some cases, such tax liabilities can be avoided by putting agreements and policies in place while the disponer is still alive.

emero is a Life Insurance broker who specialises in inheritance tax planning. Their website is packed with information on this subject along with guides and useful tips.

What is Captial Acquisitions Tax (CAT)?

You may have heard this term thrown around before but perhaps are unsure exactly what it means. We are all eligible to receive gifts or inheritances up to a certain amount over our lifetime.

However, once we pass these thresholds, a Capital Acquisitions Tax (CAT) will apply.

The current rate of inheritance tax in Ireland in 2021 is 33%.

Capital Acquisitions Tax (CAT) comprises of two sections:

Small Gift Exemption:

This is a tax on any gifts over the value of €3,000 in any calendar year. This tax applies only to gifts and not to inheritances. You will be eligible for an exemption once the total value of any gifts received is not more than €3,000.

The gift tax exemption only applies to gifts and not to inheritances.

Inheritance tax:

This is a tax on receiving a gift after someone has died. This tax is liable over a wide range of assets from cash to a house or land.

How is inheritance tax paid in Ireland?

The onus to pay the tax is always on the person who is receiving the gift or inheritance. It is worth noting that Revenue expects any tax liabilities to be settled quickly.

| Received gifts or inheritance: | Revenue expects payment by: |

| Between January – August | October 31st |

| Between September – December | August 31st of the following year. |

You have the option to pay your tax liability online via a single debit instruction or with a credit or debit card.

Alternatively, you can complete an IT38 form to send directly to Revenue. If you fail to make the payment, Revenue can charge penalties and interest until you do.

Sometimes a deferred arrangement is possible but it is in your best interest to settle any liabilities as soon as possible. We understand that this will likely already be a stressful period but getting your ducks in a row is important.

What happens if you are late filing a payment?

As we see from the above tables, it will be dependent on when the inheritance was received with regard to what date payment must be made.

If you are not a resident in Ireland , it is your responsibility to organise an agent in Ireland, such a solicitor to ensure your Capital Acquisitions Tax payment is made to Revenue.

If you are late filing a payment but pay the tax by October 31st, there is a late filing charge.

| A delay of 2 months or less | 5% |

| Any delay longer than 2 months | 10% |

Combined with the above charges, there will also be an interest charge per day which applies. This will equate to approximately 8% per annum.

The figures above show that any delay in paying your Capital Acquisitions Tax (CAT) can prove costly. Ensure to enlist the help of an experienced professional to avoid any unnecessary delay or fees.

Who has to pay inheritance tax?

Inheritance tax affects anyone who has received a gift or inheritance over their related thresholds. These thresholds are determined by your relationship with the person you are receiving inheritance or gift from.

The person giving the gift is also referred to as the disponer.

How do I calculate my inheritance tax liability?

Calculating your inheritance tax liability will be dependent on what threshold you fall under. There are currently three different threshold groups.

It is also worth noting that a spouse or civil partner is exempt from Capital Acquisitions Tax (CAT).

| Group A | Group B | Group C | |

| From October 9th 2019 | €335,000 | €32,500 | €16,250 |

(source:revenue.ie)

The standard rate of Capital Acquisitions Tax (CAT) for gifts and inheritances is 33%.

Each group has a tax-free threshold that applies from 7th December 2011. You will only be liable to pay tax on the value of gifts or inheritances above the tax-free group threshold amount.

| Group A | Group B | Group C | |

| On or after 9th October 2019 | €335,000 | €32,500 | €16,250 |

| 10th October 2018 – 08th October 2019 | €320,000 | €32,500 | €16,250 |

| 12th October 2016 – 09th October 2018 | €310,000 | €32,500 | €16,250 |

| 14th October 2015 – 11th October 2016 | €280,000 | €30,150 | €15,075 |

| 06th December 2012 – 13th October 2015 | €225,000 | €30,150 | €15,075 |

| 07th December 2011 – 05th December 2012 | €250,000 | €33,500 | €16,750 |

Group A | Son/Daughter

Group A applies to the son or daughter of the person giving the gift or inheritance. This also includes an adopted child, a step-child, and certain foster children. Parents also fall within this threshold where they take an inheritance of an absolute interest from a child.

Group B | Brother/Sister/Neice

Group B applies where the beneficiary is a brother, sister, niece, nephew, grandparent, grandchild, lineal ancestor, or lineal descendant of the disponer.

Group C | Other

Group C threshold will apply in all other cases.

Calculation example for a Group A beneficiary

Example 1 – Son/Daughter

- Louise inherits €500,000 from her mother

- This means she will fall into Group A

- Threshold of €335,000

- €500,000 (inheritance) – €335,000 (threshold)

- As with all CAT, the tax liability will be at 33%.

Calculation example for a Group B beneficiary

Example 2 – Sibling

- Paul inherits €500,000 from his brother

- This means she will fall into Group B

- Threshold of €32,500

- €500,000 (inheritance) – €32,500 (threshold)

- As with all CAT, the tax liability will be at 33%.

Calculation example for a Group C beneficiary

Example 3 – Friend

- Laura inherits €500,000 from her longtime friend

- This means she will fall into Group C

- Threshold of €16,250

- €500,000 (inheritance) – €16,250 (threshold)

- As with all CAT, the tax liability will be at 33%.

Inheritance Tax Calculator Ireland

The above examples are useful. However, they are limited as generic figures must be used.

When it comes to Inheritance Tax planning, situations are rarely straightforward.

As we focus mainly on pensions, it is sometimes useful to use external resources.

emero are leading insurance broker who focus primarily on personal protection advice. They provide access to a free inheritance tax calculator.

Using such a calculator will allow you to enter your specific details and calculate whether you may have an inheritance tax bill on the horizon.

Their website also contains several other resources on personal protection and snippets of useful advice.

What if you have previously received an inheritance?

The thresholds we looked at above are lifetime thresholds with that particular relationship. For example, if some years ago you received €50,000 from one of your parents, your threshold would reduce from €335,000 to €285,000.

If you pass your threshold completely with different inheritances, anything received from that point on will be taxed at 33%.

However, there are insurance policies available to combat this which we’ll look at in detail further on.

Estate Planning

At this stage, you may be concerned about the potential tax liabilities coming your way. However, there are certain actions you can take as both the gifter (disponer) and the recipient.

As we know, if you are a spouse or civil partner, the assets will pass tax-free.

Although, perhaps you are a parent or grandparent wondering how you can minimize the tax liabilities of the recipient. Well, there are some options available.

For example, if you are a grandparent looking to provide future financial support for a grandchild you could do the following:

Deposit €3,000 per year into an account in their name. This would be below the annual gift threshold and allow it to be transferred tax-free. If this was started when a child was born and done each year you could amass €54,000 tax-free when the child reaches age 18.

Inheritance tax reliefs

There are also some specific reliefs available for a particular set of circumstances.

Dwelling house exemption

If you inherit a house and qualify under the dwelling house exemption, you will not be liable for Capital Acquisitions Tax (CAT).

The rules surrounding this exemption are:

- The home must be the main residence of the person who has died.

- The individual inheriting the home must have lived there for three years before the homeowner’s death.

- The individual inheriting the home must remain living in the home for six years after it is inherited.

- The individual inheriting the home must not have an interest in any other property. This also includes any other properties that may be part of the same inheritance.

In some cases, there may be multiple properties that must be taken into account to try and minimise any CAT liabilities.

However, the above stipulations do not apply if:

- You are over age 65 at the time of inheritance, or

- Are required because of employment to live elsewhere, or

- You are required to live elsewhere because of your physical or mental state as certified by a doctor.

Business Relief

A business is regarded as any activity, trade, or profession which generates income or profits over time. If you inherit a business, you may qualify for business relief. This relief may enable the value of the qualifying business to be reduced by 90% when passed to a beneficiary.

The beneficiary must retain the business for a minimum period of six years and must ensure certain stipulations are met. If not met, there may be a clawback.

If you find yourself in this situation it would be advisable to consult the help of an expert with experience in these situations.

Agricultural Relief

This is similar to business relief where the value of an agricultural property can be reduced by 90% when passed to a ‘farmer’.

To qualify for agricultural relief as a farmer, the value of your agricultural property must:

- Consist of at least 80% of your total property value on the valuation date. This is referred to as a ‘farmer test’.

Revenue provides an in-depth analysis of the rules surrounding agricultural relief and the exemptions attached.

Favorite Niece/Nephew

In some cases, a niece or nephew of the deceased may be treated as a child and therefore fall under the €335,000 threshold. There are various conditions that must be met to be eligible for this relief.

Other inheritance tax exemptions?

As well as some of the potential reliefs we touched on above, there are some exemptions available. These include:

- Gifts or inheritances from a spouse or civil partner

- Payments from damages or compensation

- Benefits used for medical expenses

- Benefits taken for charitable purposes or received from a charity

- Winnings from any lottery, sweepstake, or betting

- Retirement benefits and pension/redundancy payments. However, scheme and specific rules will apply.

- Support for the maintenance or education of a child or spouse/civil partner.

Using an insurance policy to cover an inheritance tax bill

If you are wondering how you can avoid your beneficiaries being hit with a large inheritance tax bill, there are some ways around this.

A Section 72 policy is a Revenue approved insurance policy. It is designed to cover the costs of an inheritance tax bill.

What is a Section 72 policy?

Formerly known as a Section 60, a Section 72 policy is taken out to help pay any inheritance tax bill your beneficiaries may face after your death. They are tax-efficient solutions and with the correct policy in place, it may save them some tough decisions.

A lot of the time after death, there is a significant tax bill to be paid as assets are passed.

For example, let’s say you inherit the family home from your parents.

It is not unreasonable to see a house priced at €650,000. Particularly in our bigger cities although let’s not get into that.

| Cost of home – €650,000 |

| Threshold (Group A) – €335,000 |

| Previous inheritance – €0 |

| Taxable inheritance – €315,000 |

| Tax payable (33%) – €103,950 |

All of a sudden you are left with a tax liability of €103,950. Not too many of us will have a spare €100+ grand lying around to pay this. Therefore, it is likely you will have to sell the house to pay the tax bill.

However, this is where a Section 72 policy would be advantageous. The policy will provide a lump sum whenever you die which your beneficiaries can use to pay any tax bill that may arise.

The money itself is free from any inheritance tax liability once it is used for that purpose.

Who can take out a Section 72 policy?

A Section 72 policy is most often taken out by parents to pass assets to their children while helping them avoid a hefty tax liability.

Your circumstances and assets may likely change over the years. However, the full amount of your policy will be paid when you die.

If the cover of the policy is more than the tax owed, the full amount will still be paid out. Therefore, your beneficiaries may be liable to pay inheritance tax on the additional amount.

Setting up your Section 72 policy can be done in two ways:

- Cover your own life only. A single-life policy paying out on your death.

- Cover for husband and wife/civil partner on a joint life, second death basis. This policy will when both persons covered in the policy die.

It is worth noting that under the second option, premiums continue to be paid after the first death.

Section 72 policy can be quite costly so this is something to keep in mind. If you are unable to continuously pay the premiums the policy will be ceased and cover will end.

It is also worth noting that the maximum age you can take about a Section 72 policy is age 74. The policy would need to be in place before you turn 75.

How much is a section 72 policy?

As with any insurance policy, there is no universal cost as it will depend on several factors. It will also depend on how much cover you want.

However, Section 72 policies are more expensive than your average policy. Therefore, you must be committed to paying the policy for the duration.

Should you cease paying your premiums at any time, the policy will become void.

Section 72 policy vs standard life cover policy

We know a Section 72 policy is set up to pay an inheritance tax bill. Once you die, the policy pays out a lump sum to your beneficiaries which can be used to pay the tax bill.

The money itself is free from any tax liability once it is used to pay the inheritance tax bill.

This is different than if you had a standard life policy. With an ordinary life cover policy, this agreed amount of this policy will become part of your estate. Therefore, it will be liable to inheritance tax.

| Policy | Cover Amount | Inheritance Tax Owed | Remaining Amount |

| Standard Life Policy | €200,000 | €66,000 (33% of €200,000 if no threshold is available) | €134,000 |

| Section 72 Policy | €200,000 | €0 | €200,000 |

The above illustrates the benefits of having a Section 72 policy in place. In the case of a standard life insurance policy, you may face a hefty tax bill on any inheritance.

Whereas with a Section 72 policy, its sole purpose is to avoid any inheritance tax that may be liable.

However, it can be quite a complex area of financial planning and is worth consulting with an expert.

How is inheritance tax on property abroad calculated?

In some cases, you may have to pay inheritance tax in Ireland and other countries. The specific rules will depend on the country involved.

For example, in Ireland, you can claim a credit against Capital Acquisitions Tax (CAT) if you have paid tax on a foreign property. Again, this will be subject to certain stipulations and will depend on the country.

Countries such as the United Kingdom and the United States may be eligible for relief.

Inheritance Tax on property in the United States

As mentioned above, there is an agreement in place between Ireland and the United STates which covers inheritance tax. You will only be charged tax on property located abroad if the person giving the inheritance is either:

- Domiciled in Ireland or

- A non-resident in the United States

For example, if you are an Irish resident and inherit property outside of Ireland from a United States resident, there will be no inheritance tax liability.

However, the United States will have its own tax liabilities that will need to be settled.

Inheritance Tax on property in the United Kingdom

With regard to inheriting property in the UK, this is more complicated than in the case of the US.

It is likely that you will need the help of a solicitor or tax specialist. Or perhaps both.

Revenue also has resources available on this subject.

What happens to my pension if I die?

For a lot of people, besides your house, your pension is likely to be your largest financial asset. Surprisingly what happens to my pension if I die is a question we get asked quite frequently.

Therefore, understanding how it will be inherited on your death is important. How it will be inherited will depend on several factors.

Whether you are pre-retirement or post-retirement will have an impact. Any pension benefits passed to your beneficiaries may be liable to Capital Acquisitions Tax (CAT). Again, your relationship with the beneficiary will decide the threshold available to them.

We’ve looked at this specific area in greater detail in our other blog.

Don’t Get Left Behind!

Enjoy this blog?

We send out a short email every Thursday with some tips and information we think may be useful.

Join over 2,000 subscribers who enjoy our weekly tips!

What to do next?

Hopefully, the information in this blog has provided some clarity as to how inheritance tax in Ireland works.

There are quite a few rules and stipulations but it boils down to having your affairs in order. It is also important not to fall into the trap of thinking it is a policy only the wealthy should have. Particularly as house prices rise to an all-time high.

Threshold A of €335,000 would not cover many properties in Dublin at the moment. However, it is worth noting that Section 72 policies can also be costly.

It may or may not be the right decision but it will depend on your specific circumstances. There is no one-size-fits-all approach to financial planning.

Enlist the help of a good advisor who will take a non-jargon approach. Take time to assess all potential options. If anything is still unclear we are always available to help where possible.

Thanks for reading!

| Contact Details: | |

| Email: | info@pensionsupportline.ie |

| Phone: | 01 963 0438 |

Complementary Inheritance Planning Consultation

*This blog should be used for information only and not taken as financial advice.